What causes companies to pay less in effective taxes than the statutory tax rate?

If the US tax rate is 21%, why do some companies report paying less than that? Considerably so.

Well, the difference arises from permanent book-tax differences.

That is transactions that permanently result in the book taxes differing from how much is paid in cash taxes.

Firms are required to disclose this information.

Take Amazon.

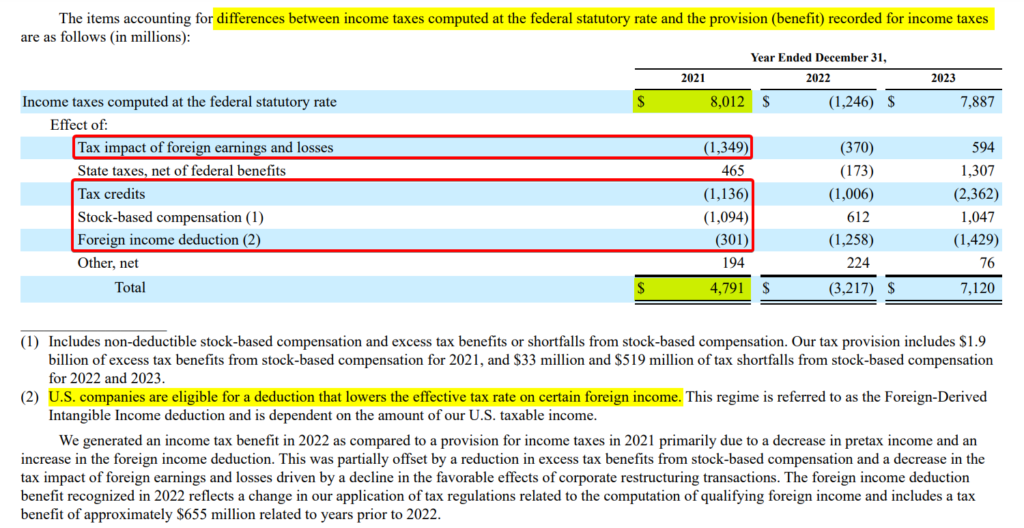

We can see in the footnote for income taxes (Note 9) that Amazon reconciles its federal statutory taxes (the amount the company was expected to pay at the 21% tax rate) to its effective tax rate (how much it reports for taxes on its income statement).

What are the largest drivers of the permanent book-tax differences?

Impact of foreign earnings – maybe because of lower tax rates in the foreign countries it conducts business in.

Tax credits – the government uses taxes to incentivize or discourage certain behaviors.

Amazon is doing a lot of good when it comes to creating jobs and investing in cities. So, the government rewards it for certain investments it makes.

Bottom-line? It’s not that Amazon doesn’t pay enough taxes, rather it is that the tax code does not tax them as much as some people would like.