An option gives us the right to convert into shares.

So, why don’t we always exercise that right?

Say we owned Tesla options.

Who doesn’t want shares of Tesla?

Well, like everything in finance. It depends on the price.

If the price is not right, it may not make sense to exercise the option.

By exercise, we mean take the option and move forth with converting it into a share in the company.

Aka you are exercising the rights you have under the option contract.

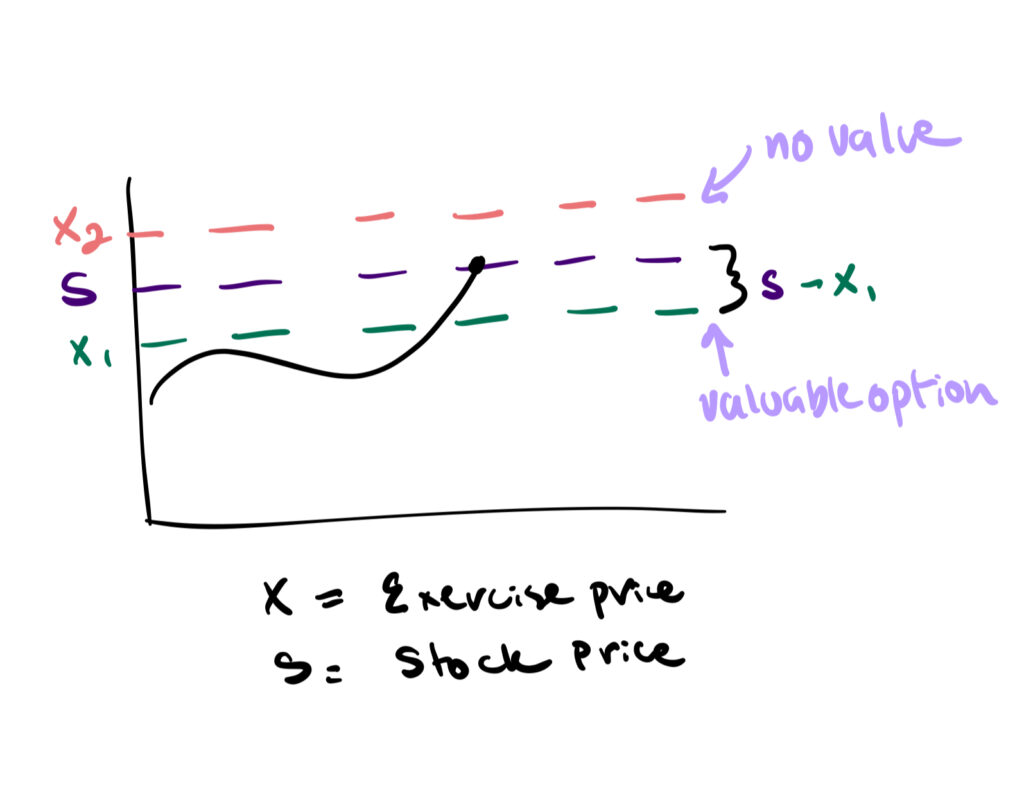

If the market price is above the exercise price (the price you can transact the shares at), then it makes sense to buy the shares at the exercise price. Then, go into the market and sell it at the market price.

If the market price is $60 and the exercise price is $50, I would want to exercise my right to buy at $50 a share.

Then, I would go and flip those shares in the market at $60 and make the $10 difference.

Although, I do not need to sell the share right away and could opt to hold on to it if I so wanted.

Take the opposite case.

If the market price is $50 and the exercise price is $60, I would not want to exercise my right to buy at $60 a share.

I would never buy a stock for more than it currently trades at. This makes the option worthless at expiry.

Bottom-line? It may not always make sense to exercise options.