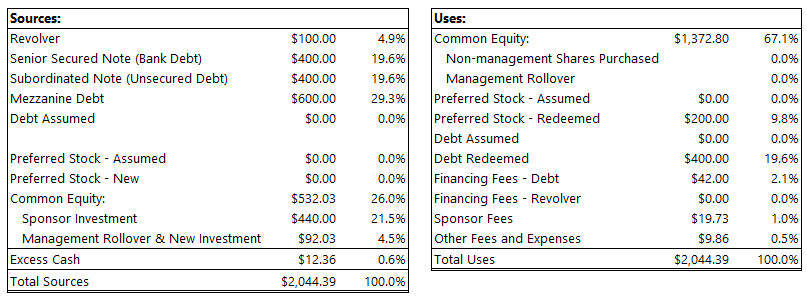

What are the sources? What are the uses?

At its core, a deal is a financial transaction between two parties.

If you are acquiring a company, you are exchanging capital for the business.

In doing so, you need to first establish what is the amount of capital that must be transferred to the seller in order to acquire the company.

These are known as the uses.

What are different uses of capital?

- Equity Purchase Price – premium paid to acquire equity in the company

- Debt Repayment – retiring existing debt of the target company

- Preferred Stock – retiring preferred shares of the target company

- Financing Fees – fees on debt

- Transaction Fees – legal fees, investment banking fees, due diligence costs, etc

Now, we need to fund the deal. And, the sources represent where the funds for the deal come from.

What are different sources of capital?

- Excess cash – from the target company’s balance sheet

- New Debt

- Sponsor Equity – investment from the financial sponsor

- Management Equity – rollovers and new investment

- Seller Financing

Bottom-line? A Sources and Uses (S&U) schedule outlines the financing structure of an acquisition. It details where the funds (sources) for the acquisition will come from and how those funds will be utilized (uses). Sources must be equal to uses. In other words, you must have enough capital to fund the entire deal.