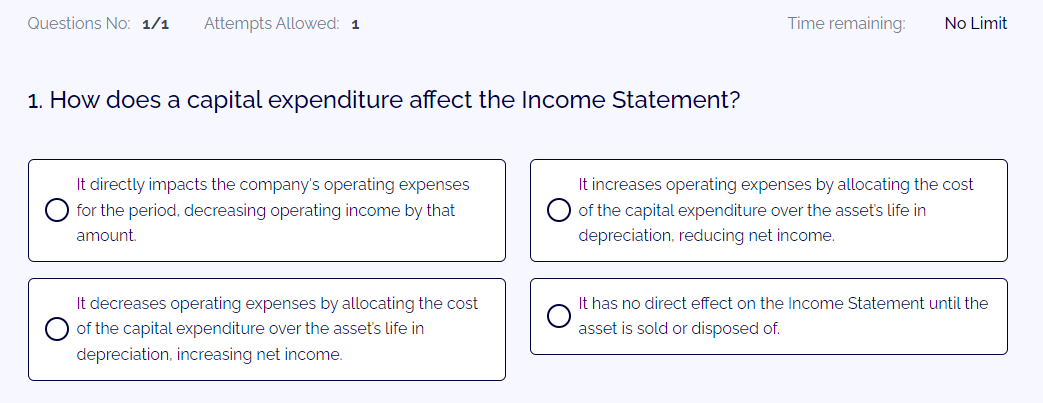

How does a capital expenditure affect the Income Statement?

A) It directly impacts the company’s operating expenses for the period, decreasing operating income by that amount.

B) It increases operating expenses by allocating the cost of the capital expenditure over the asset’s life in depreciation, reducing net income.

C) It decreases operating expenses by allocating the cost of the capital expenditure over the asset’s life in depreciation, increasing net income.

D) It has no direct effect on the Income Statement until the asset is sold or disposed of.

Answer: B) It increases operating expenses by allocating the cost of the capital expenditure over the asset’s life in depreciation, reducing net income.

Explanation: When a company incurs a capital expenditure (CapEx) to acquire or improve a long-term asset, such as property, plant, and equipment, the expenditure is initially recorded on the Balance Sheet as an asset. However, the cost of the asset is allocated over its useful life through depreciation expenses, which are recognized on the Income Statement. Depreciation reduces operating income by allocating the cost of the asset over its useful life, reflecting the portion of the asset’s value that is consumed during each accounting period. Therefore, while CapEx enhances the company’s asset base, it impacts the Income Statement indirectly by increasing operating expenses over time through depreciation, ultimately reducing net income.