Share count is completely arbitrary.

Just because a company has more shares than another, does not mean it is bigger.

Just because a company has fewer shares than another, does not mean it is smaller.

Why? Because the value of equity of a company is a function of two things.

(i) Share price

(ii) Shares outstanding

Just because there are a lot of shares outstanding, that does not tell us anything about the value per share.

If you were to issue 10 shares vs 1,000 shares at the time of issuing equity there is no difference on how valuable your company is.

Fundamentally, your company is worth some value.

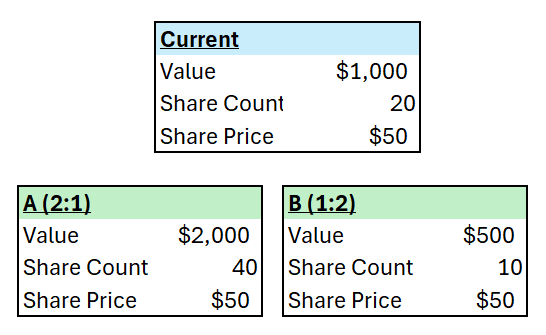

Say, $1,000.

Then, investors split the earnings into a defined number of slices (shares).

You can issue a large number of shares and minimize the share price. Or vice versa.

If you sold 1,000 shares – the market would pay $1 per share.

If you sold 10 shares – the market would pay $100 per share.

You could say that share price is a function of shares outstanding and value.

Usually, companies aim to have share prices range from $20 to $200 range.

Say the company wants a $50 stock price. Then, the company would issue 20 shares. This means that the shares would trade near $50 a pop.

Now, say the stock price increases to $100.

The company could offer a 2:1 stock split. Trading each outstanding share for 2 shares.

What happens? The number of shares doubles to 40, so the value of each share falls in half.

So, now your shares should trade at $50.

Alternatively, say the stock price plummets to $10.

In an effort to get the stock price back into the desired range, the company reduces shares outstanding.

The company could perform a 1:2 reverse stock split, reducing the number of shares to 10 and pushing the stock up to $20 a share.

Bottom-line? The value of the company does not change based on the number of shares issued. Share count is arbitrary.