Why do journalists and investors use earnings per share?

It tells us the amount of earnings a company generates.

But, why don’t we just look at net income. Why create a new line that companies must report under GAAP accounting.

There is a mathematical difference between net income and EPS.

Take this example.

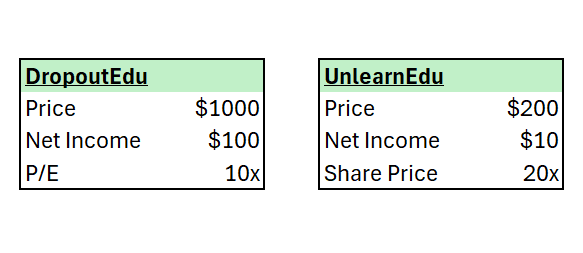

DropoutEdu earns $100 million a year. UnlearnEdu earns $10 million a year. What company is more expensive?

You cannot tell. Just looking at earnings is not enough.

We must consider how expensive it is to earn that earnings stream. Aka what is the price?

If investors are buying shares of DropoutEdu for a $1 billion valuation, investors are paying $10 per $1 of earnings.

If investors are buying shares of UnlearnEdu for a $200 million valuation, investors are paying $20 per $1 of earnings.

Now, what is more expensive?

Well, investors are paying more for UnlearnEdu.

Bottom-line? EPS is relevant because it is a relative measure of value. Whereas, net income is an absolute measure of value that tells us size but not how cheap or expensive the company is.