The goal for private equity firms is often to take on the greatest amount of leverage that the company can handle.

By handle, this means that the company should have enough cash flows to service any interest and principal repayments and then some in case things don’t go as planned.

Sponsors think about the maximal amount of debt by projecting out the free cash flows of the firm over the holding period.

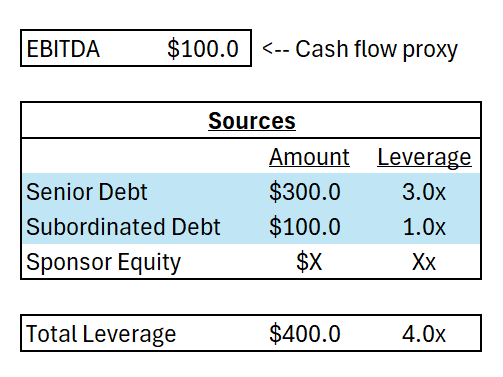

Given that EBITDA is often used as a proxy for free cash flows because it does not include non-cash charges such as D&A, investors will look at how much debt the company takes on relative to the EBITDA it generates.

Depending on how expensive debt is in the current market environment, sponsors may be able to take on more or less debt.

Similar to a mortgage on a house.

If rates are low, you will have lower monthly payments for the same house. So, you can afford to buy a bigger house if you wanted to.

If rates are high, you will have higher monthly payments for the same house. So, you may have to opt for a smaller house.

In the case of the sponsor, they may need to layer on less debt if interest rates are high because they cannot service the debt capacity in a low-rate environment.

Currently, sponsors take on an average of ~4x leverage, but this can go up to 7x on the higher end, often for larger, more mature companies that (i) have a higher price tag and (ii) have the cash flows to service the interest.

So, if the company generates $100M EBITDA, then a sponsor could go to a bank and try and get say 3x.

That gives them $300M.

Then, they could go to non-bank private lenders and raise another 1x in subordinated debt.

That gives them an additional $100M.

The goal for the sponsor is to take on the maximum amount of low-cost debt. So, they would want to maximize how much senior debt they take on to minimize the amount they must pay in interest.

But, past a point, they cannot rely on banks to provide more leverage and must tap into private lenders who will underwrite more risk.

Bottom-line? Debt is cheaper than hybrid or flat equity financing, so sponsors want to lever up the firm as much as possible to drive potential returns.