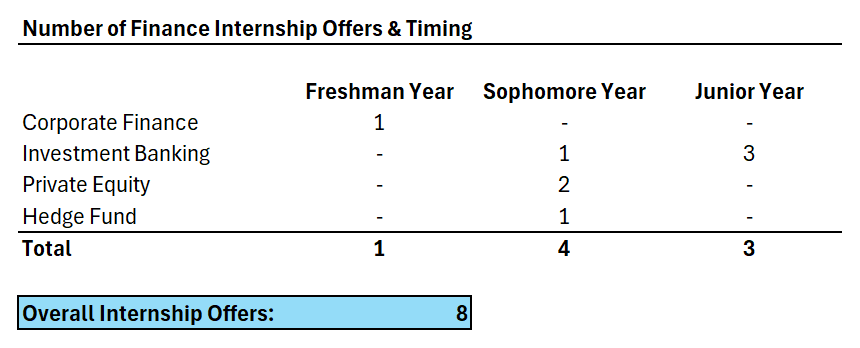

In this guide, I will provide you with the strategy that helped me land 8 internship offers in college, including F500 corporate finance, investment banking, private equity, and hedge fund roles.

Here’s my background.

In high school, I wanted to be a doctor. My whole family knew that I wanted to be a surgeon. I was shadowing doctors: dentists, periodontists, vascular surgeons, ophthalmologists, anesthesiologists. You name it.

I really enjoyed my biology, anatomy, and chemistry classes. I had a very strong allure to earn loads of money and be financially independent. I wanted to change lives. Isn’t that what the doc does. You go in the operating room and come out a healed person. At least I thought.

So in short, medicine checked my three boxes of choosing a career:

✔ Subject-matter interest

✔ Prestige and Money

✔ High-impact work

But throughout high school, I was always interested in finance. I followed the markets daily and invested. At the time, I thought that I would have a high-income job and then retire from being a great investor.

This mindset continued until junior year of high school.

In junior year, I began working a new job after school as a tutor at an EdTech company teaching the SAT and ACT. Boring, I know. I started off just doing it for the common applications process to boost my chances of breaking into top universities. And, I really admired the founder and knew I wanted to work with him.

However, after a few months, I started to grow addicted to the job. In the summer, I was regularly putting in 80-100 hour weeks, and by the end of that year, I had worked full-time.

Over 2,000 hours.

My interest for teaching continued to expand as I tutored full-time throughout senior year of school while applying to colleges.

Teaching became my identity. Thousands of students by then had known me for it. It was my only edge. I was athletic, but not athletic enough to break into college track. I had to get in through my own merit and experiences academically.

Working at that EdTech company taught me a few things:

- I like to teach and share my knowledge with eager students.

- I was getting paid a lot and on track to make 6-figures in college and heavily respected by parents and students.

- I was helping thousands of students unlock their potential and break into top colleges including the Harvards and Stanfords of the world.

In short, I stumbled across the realization that medicine is not the only impactful career. Any career can give you the following things:

✔ Money and prestige

✔ High-impact work

✔ Subject-matter interest

The same holds true for investment banking. It can fill all 3 of those buckets.

The key is that there is no one right path for everyone. We all have different interests. And, we must actively tune into it as early as possible.

So, as I applied to colleges, I applied thinking that I would study both medicine and finance (in the business school).

Through all the hard work and some luck, I was able to get into all the colleges I wanted:

✔ 1 Ivy League

✔ 1 Top 3 business school

✔ 2 Direct-medical programs

What did I do? I talked to dozens of students at these universities and programs and internalized what I wanted to do. I realized that trying to do both was infeasible.

Let me repeat this. One of the key reasons that students do not get investment banking internship offers is because they do not know that banking is right for them soon enough and then end up missing the boat.

You need to know what you want to do earlier rather than later. The sooner you can figure this out, the more time you will have to prepare. Lucky for me, I was interested in finance and learning about finance since freshman year of high school. So, I was quite in tune with the markets by that time.

As I went into college, I made one of my greatest decisions. I decided to focus completely on finance.

I knew that if I wanted to be the best, I would need to focus my sole attention on one field. Splitting my efforts would have left me in this middle ground. Neither the best in finance, nor the best in medicine.

I wanted to be the best I possibly could. And, so I dropped all my interests in medicine and enrolled in classes that would help focus all my time and efforts on finance.

Note: the students that succeeded in recruiting were the freshmen who knew that they wanted to do banking from the start, by joining finance clubs first semester. For a few reasons.

- Smart people tend to know what they want.

- People who start early have more time to gain experience.

- People who start early have more connections.

A good friend of mine was on the fence about recruiting investment banking or software engineering roles that he ended up missing out on both opportunities.

In the end, he landed an internship at a small regional bank. Sub-optimal for a kid who worked equally hard, if not harder, but didn’t know what he wanted to do when the time came.

In investment banking, the boat will come. It will be far from the shore. If you do not swim fast enough to jump on, it will leave you behind. So figure out if you want to make the swim earlier rather than later.

Moral of the story – direction matters more than speed. If he had taken some more time to introspect on what he liked learning and working on as opposed to just going through the motions of school work, he would have found great success.

Don’t know if investment banking is a good fit for you? Find out with our Investment Banking personality quiz. That will help you ask the right questions and start having the right conversations.

Before coming to campus as a senior in high school, I had about 40 or so conversations with upperclassmen going into investment banking. Through these conversations, I had learned about the relevant clubs I should join and classes I should take to best position myself.

Pro tip: Reach out to upperclassmen at your school. They are often more than happy to share their experiences with you.

Coming on campus, I recruited for 10 clubs, primarily finance and some consulting. I spent the week leading up to applications completely focused on writing applications. Yes, I skipped all my classes that week.

Going through the interview process, I was able to leverage my financial markets and real estate knowledge I gained in high school to differentiate myself.

I got into 4 clubs. 3 finance. 1 consulting. I was enamored.

I told myself, why not just join all 4? I worked quite hard to get them.

And, so I did. I was the only student to do so.

Freshman year first semester continued with a few key points:

- Maintained my GPA and focus in classes.

- Engaged with my clubs and participated in finance competitions.

- Continued teaching full-time after school.

- Continued expanding my finance knowledge.

Yeah, I know. It’s a lot. I was working every single day. No partying, nothing. It was intense, but worth it looking back.

Learned something new? Subscribe to our newsletter for more finance and business content.

As the second semester rolled around, I began going to “firm presentations.” Investment banks will often hold meetings with students at the schools that they heavily recruit at. These events are open to all students in that school.

So, being at the Ross School of Business and the ambitious freshman that I was, I had the opportunity of getting to learn the ins and outs of investment banking from the people actually doing the work early on. I was the only freshman attending the events. It was tailored to sophomores who were recruiting investment banking.

Going into the summer, I wanted to completely focus on teaching. I was growing in my role while teaching and inspiring thousands of students. I wanted to continue putting in the same 100 hour weeks that summer.

But, as I saw my friends getting internships in the business school around February and March of their freshman year, I too folded. I feared missing out. I needed to get a finance internship or I would be losing out.

And, so I did that. I applied around and landed a firm after 1 missed interview opportunity, 1 failed interview, and 2 successful interviews.

Lucky for me, it was relevant experience. It was doing corporate finance, in-house finance, at a large company. That too 20 miles from home, a short-drive. So, I could also continue teaching after work.

Pro-tip: Try and get relevant experience as early on. The decision to cut back some of my teaching hours to gain relevant experience and skills was fully worth it looking back. And was what I leveraged to get later internships.

Freshman year ended on a strong note, I was teaching everyday and maintained my grades and had an internship in hand.

Going into the summer, I had a lot of time to teach before and after the internship had started and ended. Once the internship started, I had the opportunity of learning a new role in a completely different environment.

30,000 employees. Dozens of buildings. The internship opened my eyes to working in corporate America. It was amazing, mainly because of the novelty at the time.

I worked hard there and tried to contribute as much as possible. I was able to have conversations with the founder, CEO, CAO, CRO, President, etc. It was an experience that I recommend everyone to seek.

Do internships that are in the field you want to get into.

- It shows you whether the work actually interests you based on the tasks you are required of.

- It shows you the culture and feel by immersing you in that environment in a way that textbooks cannot.

- It helps you build your network and find mentors to help guide you.

- It helps build your story to help show why you want to go where you want to go.

Throughout the summer I continued teaching, but also mastering the investment banking technicals, which I had already started in freshman year.

It’s important to note that most business schools across the country do not teach investment banking technicals. And if they do, it is often not all in one class.

It is a mix of classes that indirectly prepare you for investment banking.

✔ Financial Accounting 1

✔ Financial Accounting 2

✔ Corporate Finance

✔ Valuation

✔ M&A Strategy

But, there is one big problem. Schools do not teach it in time for interviews, which have moved up to sophomore year. Most schools will only teach related concepts in junior and senior year in college. By then, it’s not useful. Investment banking recruiting is over.

As freshman summer wrapped up, I went back to campus as a sophomore. I was confident with my internship experience and all the finance technicals.

Lots of fire power, ready to conquer what came my way.

First, I joined the investment banking club. This was the most relevant club at my school for sophomores wanting to get into investment banking. Second, I joined the endowment fund. Both clear signs to bankers that I was likely a top student that knew the role well.

So, I added 2 more organizations to that list of 4. But, I prioritized the 2 that I joined significantly.

Come October, I started networking heavily for sophomore summer internships. 500 emails later, and give or take 100 networking calls, I walked away with 2 internships. 1 at a hedge fund and 1 at a private equity firm by November/December. I worked very hard for these and had my technicals mastered to the tee.

All the while, I was doing a private equity internship during the fall that I had got the prior summer. It was not a lot of work being remote. So, I leveraged my 2 internships in order to get the sophomore summer internships. That’s why it matters. These internships are used as steps in the process to get to the main investment banking offer.

And like that, sophomore year first semester ended.

- Maintained my GPA, staying focused in class.

- Worked the internship.

- Participated in clubs/competitions.

- Continued teaching.

- Landed 2 sophomore year internships.

As I went off for winter break, I canceled all my plans and committed to spending at least 80 hours both weeks studying. This is where I was able to take my technical skills from 80% to 100%, good to mastery. I spent hours talking to myself and rehearsing each interview question to perfection.

It was a lot of reading, writing, and talking to myself. Again, again, and again.

While most people might dread such a break, I found that I was learning more than I did in school. That too learning something that I found very interesting and meaningful.

Note: if you do not like the materials you are learning about, that is probably a good indication that you will not like investment banking itself, which deals with all those concepts on a much deeper level. Likewise, if you do not like accounting, investment banking may not be the best fit for you.

Importantly, at the end of break, I spent a few days getting all my networking templates and spreadsheets ready. These helped me stay organized. It told me exactly who I would reach out to on what day, when I would follow-up, their email, etc.

This made it so that all I had to do was execute the networking calls and then update my tracker.

Note: as investment banking recruiting moves up, it is beneficial to start recruiting for junior year summer in late November to early December before winter break your sophomore year. Early, I know.

As I came back to campus on January 3rd, I began sending my networking emails to my list. The month of January comprised of, typically, 5 hours of sleep and 40 networking calls.

I would come back from the gym most days at 11pm, and then begin to update my networking tracker and schedule send emails from 12am-3:30am and then wake up for my 8:30am accounting class.

It was tough. But, I acknowledged that I have sprints, periods of time that really matter which I commit high intensity to. This is what I used to teach my high school students. The same applies in college. There are certain weeks/months that you need to just put your head down and work. For me, this was January. I hustled.

As February rolled around, I continued networking another 40 or so calls and was fully interview ready. I applied to all the investment banks by the end of the month and had an early interview in private equity.

That interview led to a superday, which then led to my first real rejection. Oof, that hurt. But, it happened for the better as the role would not be best suited for me.

In March, interviews were in full swing. By April, I had completed exactly 30 interviews at 17 firms for my junior year internship. Finally, the race was over as I signed on the dotted line, accepting 1 offer.

It was a roller coaster of a process, but I was fully prepared all the way through.

The later part of the story goes quick. Junior and senior year of college:

- Maintain GPA.

- Continue teaching full-time.

- Continue expanding my finance knowledge daily.

That’s all there is to it.

The key takeaways from my experience of breaking into investment banking or wall street firms numerous times?

- Find out if this is really what you want to do. If it is, commit to it fully. If not, that’s fine.

- Start preparing earlier rather than later. It is never too early, I started in high school.

- Join clubs on campus and take courses in investment banking to gain knowledge that schools just don’t seem to teach.

- Stack relevant experience on your resume to get the main offer.

Interested in preparing for investment banking? Check out our in-depth live investment banking courses.