We often hear that EPS captures all the effects of a transaction.

What does this really mean?

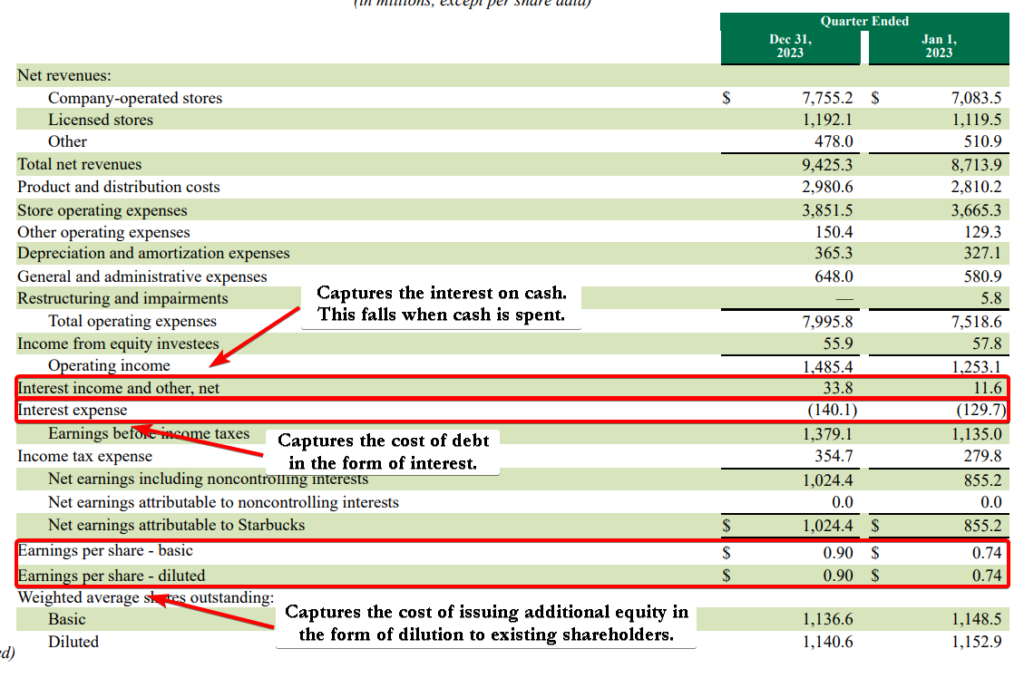

Well, it refers to the fact that EPS captures the full cost of capital.

It does so in a way that other income statement metrics wouldn’t like net income, EBIT, EBITDA, gross profits, or revenue.

What do we mean by cost of capital?

First, we know the income statement already captures the economic reality.

That is the estimated earnings from operating the business over a period of time.

But, to generate those earnings, companies must raise capital.

There are three main ways to do so.

1. Simply use cash on the company’s balance sheet that is generated from operations.

2. Raise debt capital.

3. Raise equity capital.

The first 2 are relatively simple to visualize.

The third is where other metrics fall short.

If we think about using cash. What are the effects of spending cash?

Well, that cash that we would have had sitting in a bank account cannot earn interest.

So by spending cash, we lost the interest expected on that cash. We can think about this as an opportunity cost on that cash.

How does this affect earnings? It reduces earnings because our interest received decreases by the post-tax amount of cash spent x interest rate on that cash.

Raising debt capital is yet simpler. Interest expense goes up by debt issued x interest rate. So, earnings fall by the post-tax value of that.

The more complicated one is equity because of the legal treatment.

Companies do not have an obligation to pay equity investors a stream of income or any proceeds.

This means there is no real expense on the income statement.

But, this is not really true. We know issuing equity dilutes the value of your and my shares (existing shareholders that is).

So, what captures that?

EPS does.

If shares go up, the denominator gets larger, driving the EPS measure down.

Bottom-line? We say EPS captures all transactions because it fully accounts for the cost of capital of a firm.