Do we care about basic or diluted shares in M&A?

In M&A, the acquirer (buyer) is attempting to buyout the target (seller).

In order for the buyer to purchase each outstanding share in the selling company.

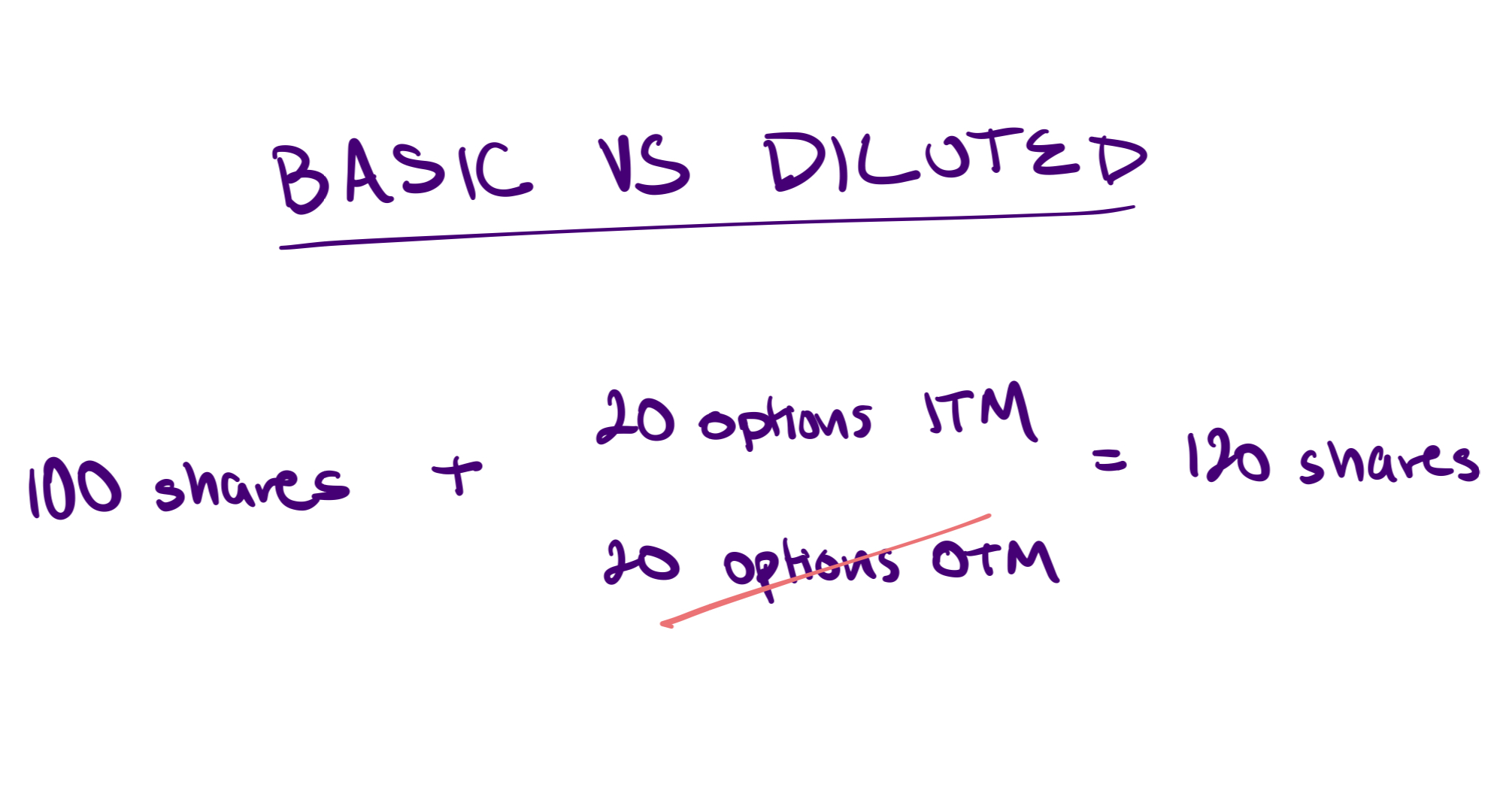

So, if the target has 100 shares, the buyer would need to buyout the entire 100 shares to acquire 100% of the company.

But, most companies have a different number of basic and diluted shares.

Why? Because they issue dilutive securities.

What is an example of dilutive securities? Options. Or anything that has the ability to be converted into equity but is not equity in its current form. Could also be certain types of debt.

Then, the question becomes how much dilution gets created. And, that depends.

It depends on how many dilutive securities could be converted to equity based on the acquisition price.

Dilutive securities have conversion prices – the price at which the holder can convert the security into equity.

If the stock price exceeds the conversion price, the dilutive security is “in-the-money.”

If the stock price is below the conversion price, the dilutive security is “out-the-money.”

So, we can see that any in-the-money option is valuable.

But, we do not know when the securities will be converted into shares.

But, in the case of M&A, we assume that all dilutive securities that are in-the-money will be exercised, so this drives up the number of shares that the buyer must purchase.

Since equity purchase price is equal to shares outstanding times share price, the equity purchase price will increase.

Bottom-line? Acquirer’s care about the diluted equity value because that’s how much the expect to pay to cover outstanding equity.