Try Problem Check answer here. Only once you’ve tried… Interested in more? Start learning with our learning modules on the accounting here.

Question of the Day 7/14

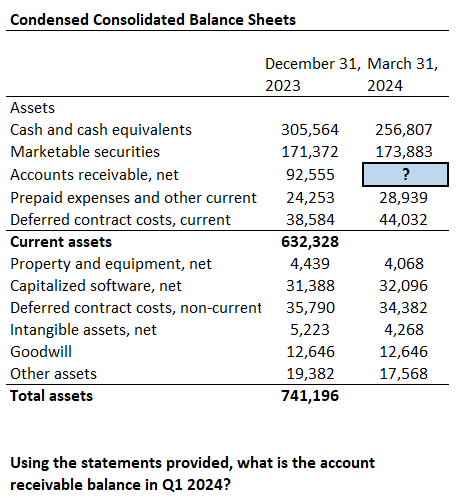

Try Problem Check answer here. Only once you’ve tried… Interested in more? Start learning with our learning modules on the accounting here.

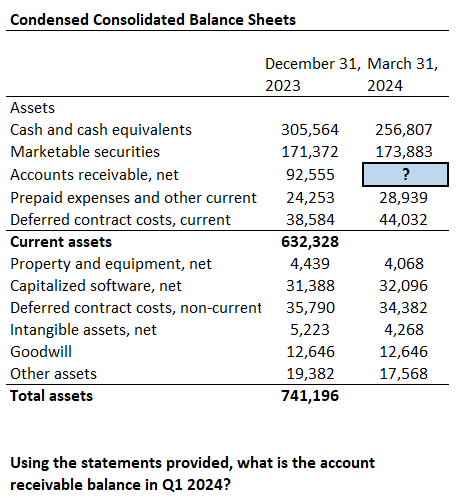

Try Problem Check answer here. Only once you’ve tried… What is Pepsi’s debt to equity ratio? Round answer to 1 decimal place. 20.4% What is Celsius’s asset beta without taking into consideration any comparables? Round to 2 decimal places. 1.65 What is the average unlevered beta of the comparables? Round to 2 decimal places. 0.62 Assuming you use the average

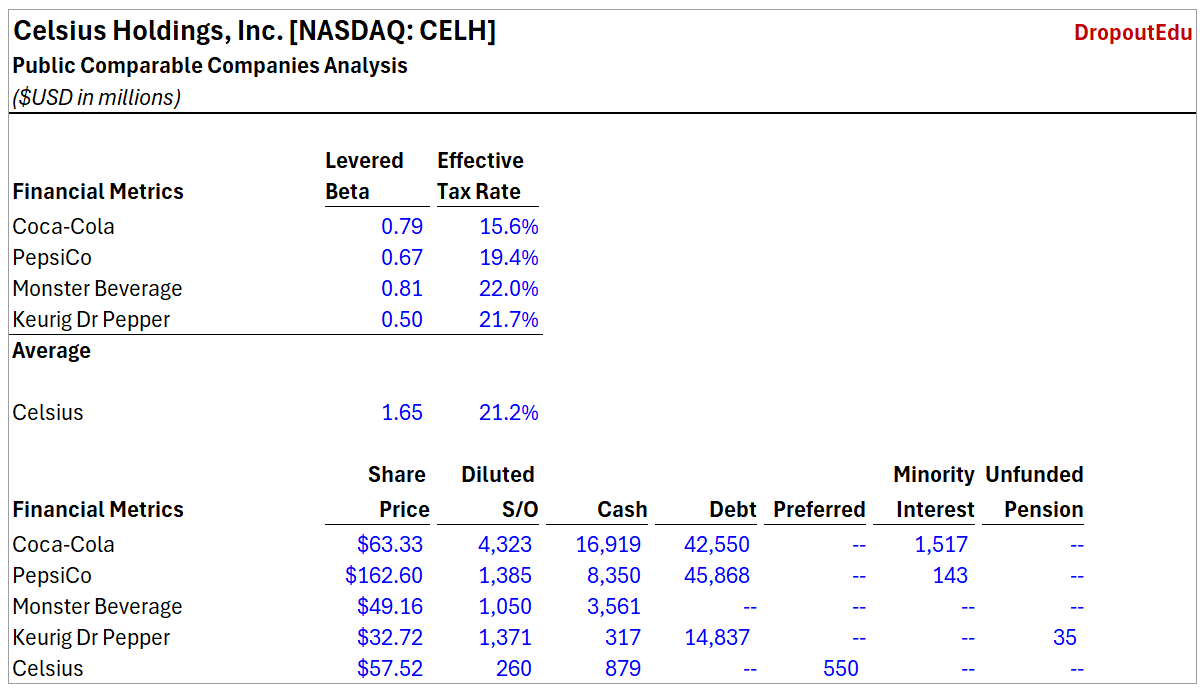

Excel File Click here to view answer. Only after you have attempted… What is the market value of Dutch Bros? Round to the nearest whole number in millions. 8,106 What is the enterprise value of McDonald’s? Round to the nearest whole number in millions. 216,094 What is the LTM EV / EBITDA multiple for Restaurant Brands? Round to tenths place.

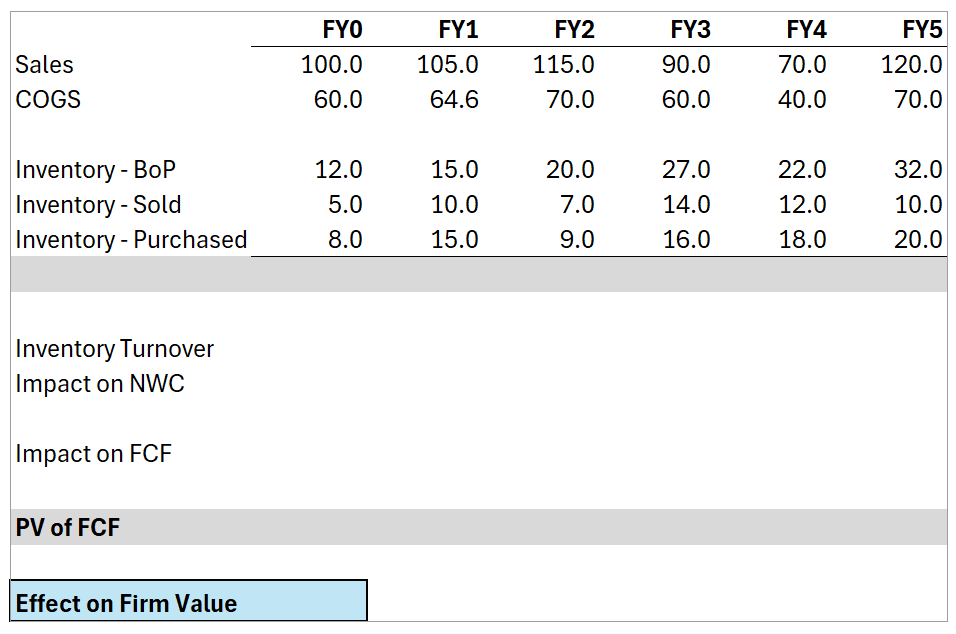

Excel Exercise View Excel answer here. Only after trying… Does inventory turnover increase or decrease? Decrease What is end of period inventory in FY4? 28 How how much does inventory turnover change by on a percentage basis? Round to the nearest tenth and use negative signs if needed. -45.8% What impact does inventory turnover falling have on valuation? Decreases valuation

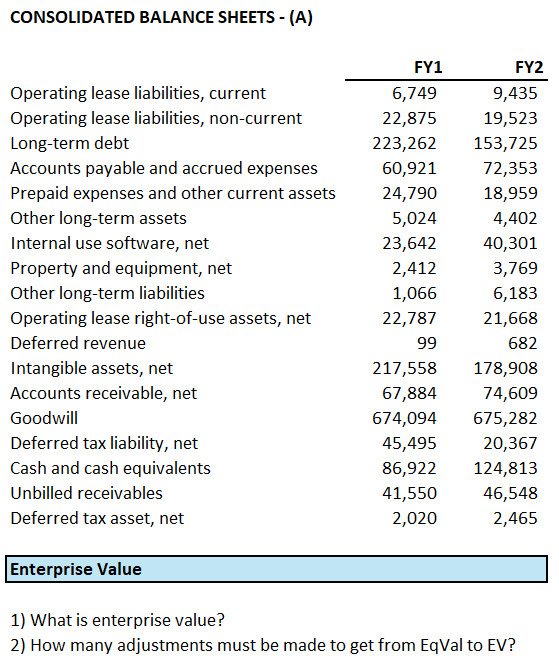

Excel File Check solution here.

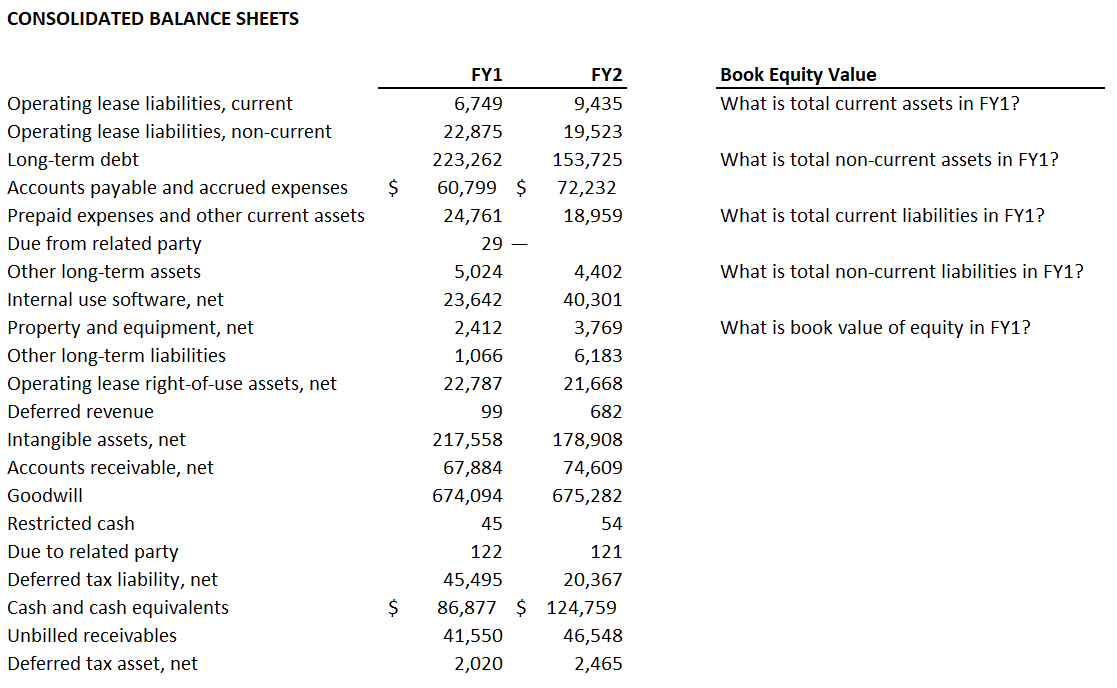

Download Excel Data File What is total current assets in FY1? 221,146 What is total non-current assets in FY1? 947,537 What is total current liabilities in FY1? 67,769 What is total non-current liabilities in FY1? 292,698 What is book value of equity in FY1? 808,216

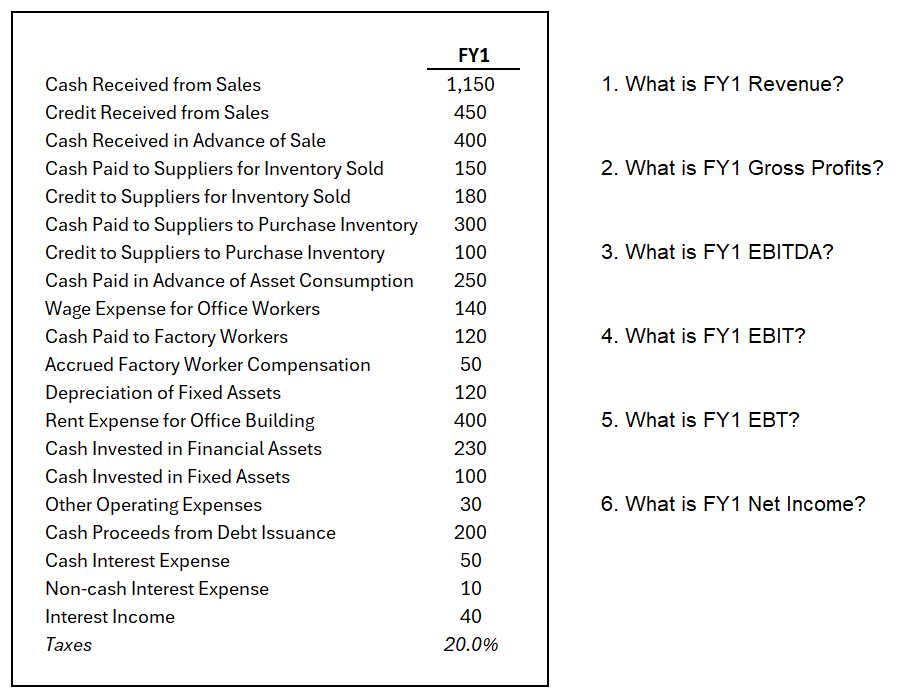

1. What is FY1 Revenue? 1,600 2. What is FY1 Gross Profits? 1,100 3. What is FY1 EBITDA? 560 4. What is FY1 EBIT? 440 5. What is FY1 EBT? 390 6. What is FY1 Net Income? 312

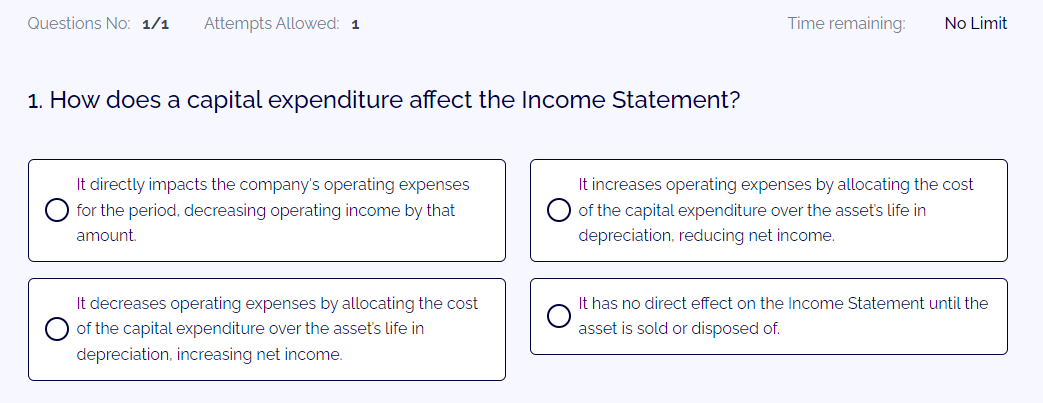

Question How does a capital expenditure affect the Income Statement? A) It directly impacts the company’s operating expenses for the period, decreasing operating income by that amount.B) It increases operating expenses by allocating the cost of the capital expenditure over the asset’s life in depreciation, reducing net income.C) It decreases operating expenses by allocating the cost of the capital expenditure

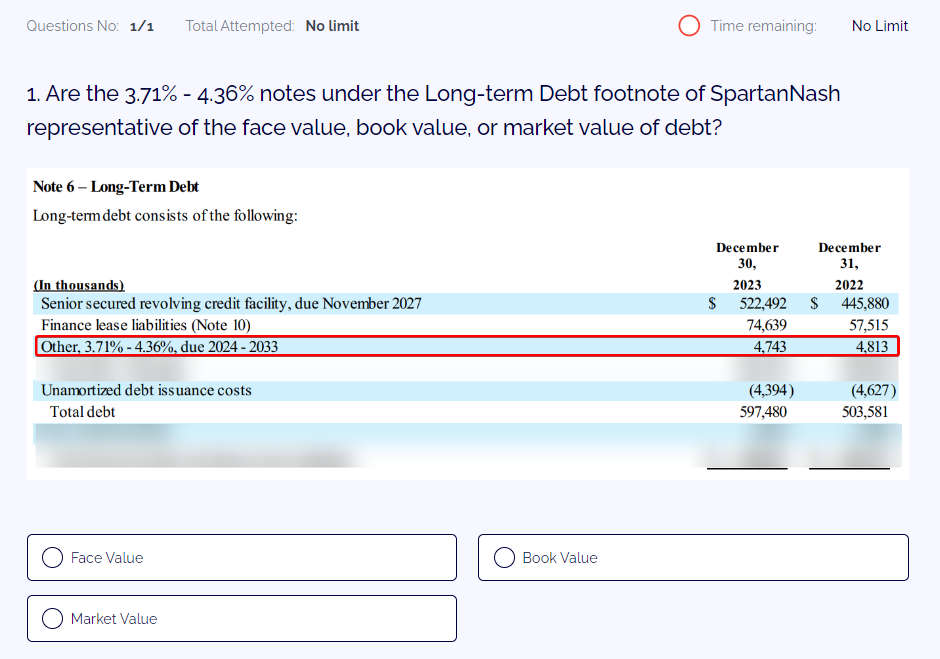

Question Are the 3.71% – 4.36% notes under the Long-term Debt footnote of SpartanNash representative of the face value, book value, or market value of debt? A) Book Value B) Face ValueC) Market Value Answer Answer: B) Face Value Explanation: The total debt represents the face value of debt which is directly plugged into the company’s long-term debt balance on

Question In January, DropoutEdu sold and delivered $100 worth of textbooks to customers. But, the customers only need to pay cash for the purchase in February. Assuming a 25% tax rate, how much would DropoutEdu report in earnings in February? Answer Answer: 0 Explanation: Cash is irrelevant to income statement earnings. The goods were transferred in January, so it does