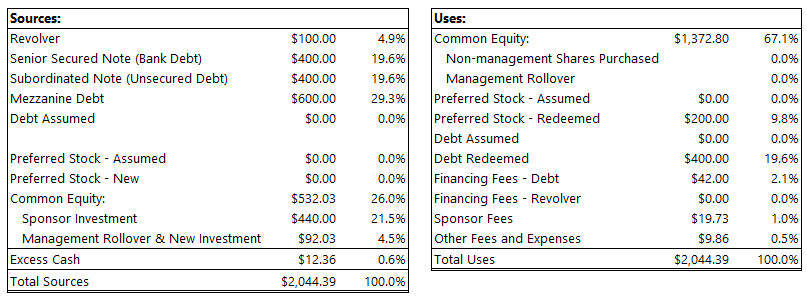

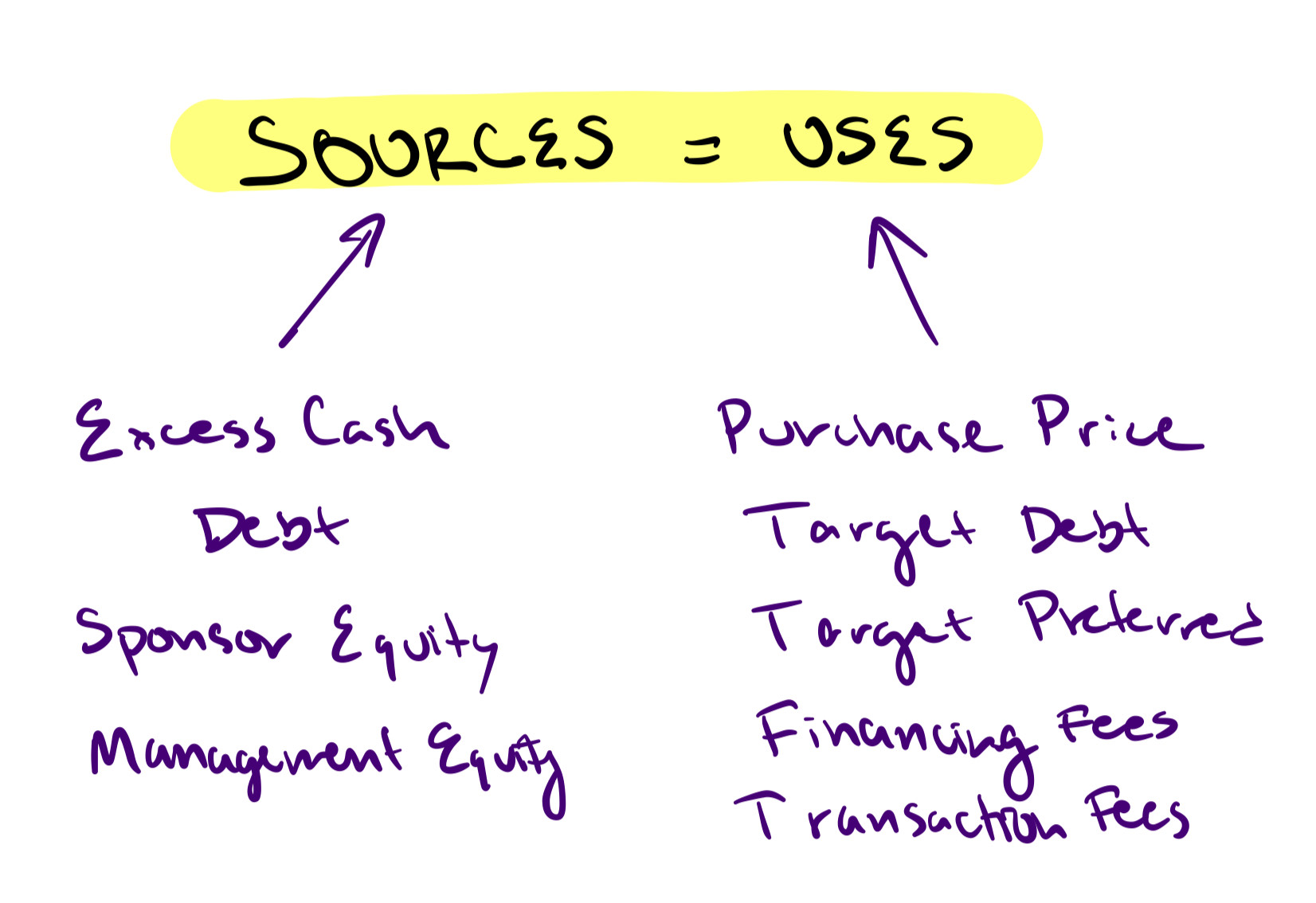

Why do private equity firms want to invest the least amount of money into a deal? Don’t private equity firms have a lot of money to invest? Yes. Isn’t it because they want to diversify their holdings? Maybe. But, the real reason is math. By that, I mean that mathematically you generate the highest relative returns when you invest the

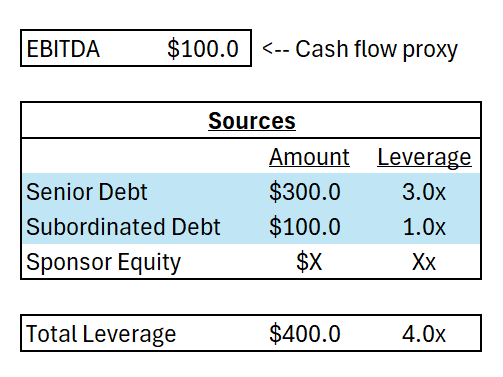

Why Use So Much Debt?