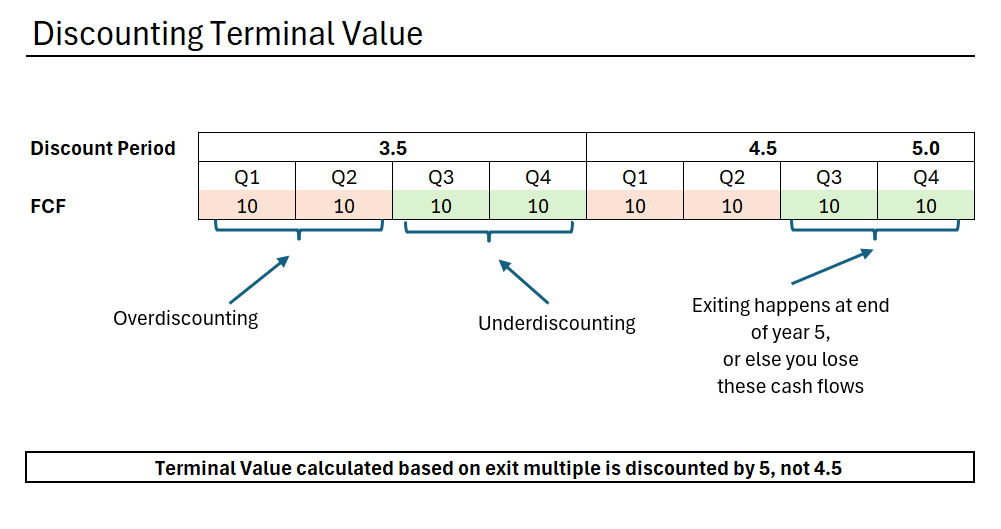

If the terminal year cash flow is discounted by 4.5 years, why would we discount the terminal value by 5 years? There are 2 ways to determine the terminal value of a company. In the first case, we are implicitly projecting the growing cash flow stream indefinitely. Then, finding the present value. In this case, it makes sense to keep

Discounting Period Under Exit Multiple Approach