Can you calculate IRR on paper? No.

Well, that is unless you are a mathematical wizard with 200+ IQ.

Well, even then, it’s really not possible.

While the steps can be understood, the mathematical computations are nearly impossible to do on paper.

Maybe you could take the 9th root of a cash flow in year 9.

OK, very impressive, but can you iteratively do that 100 times.

It would take me decades.

But, Excel can run that calculation in a mere millisecond.

What is it attempting to do? Calculate the average compounded return on a series of cash flows.

What makes it so difficult to calculate? Cash flows are not constant. They fluctuate. As a result, we must account for the time value of money.

You cannot assume that the IRR of an investment is (FV / PV) ^ (1 / n) – 1. That assumes all the returns come at the end.

So one way to do this is to solve for the discount rate, which is also your compound rate. You are just going in opposite directions.

Compounding is going from value of money today (present value) to value of money some years from now (future value).

Discounting is going from value of money today (present value) to value of money some years from now (future value).

The discount rate that we solve for will make the future cash flows equal to the initial investment amount.

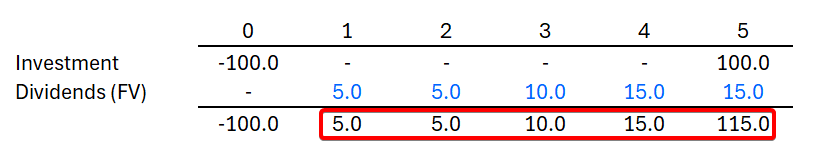

Say you invest $100 today and expect cash flows of $5, $5, $10, $15, $115.

The discount rate should make the value of that cash flow stream equate to our initial investment.

The cumulative cash flow stream is $150.

We want to find the discount rate that results in that stream of cash flows equating to $100, the initial investment amount.

Again, we cannot simply use (FV / PV) ^ (1 / n) – 1. That assumes all the returns come at the end.

But, that is not the case here. So we need to account individually for each cash flow based on when it is received.

With enough trial and error we can see that the discount rate that would value the stream of cash flows at the initial investment amount of $100 is 9.5%.

That discount rate is what we call the IRR.

Try doing that in your head.

Bottom-line? To determine IRR, we can make estimates but not calculate the exact value on paper.