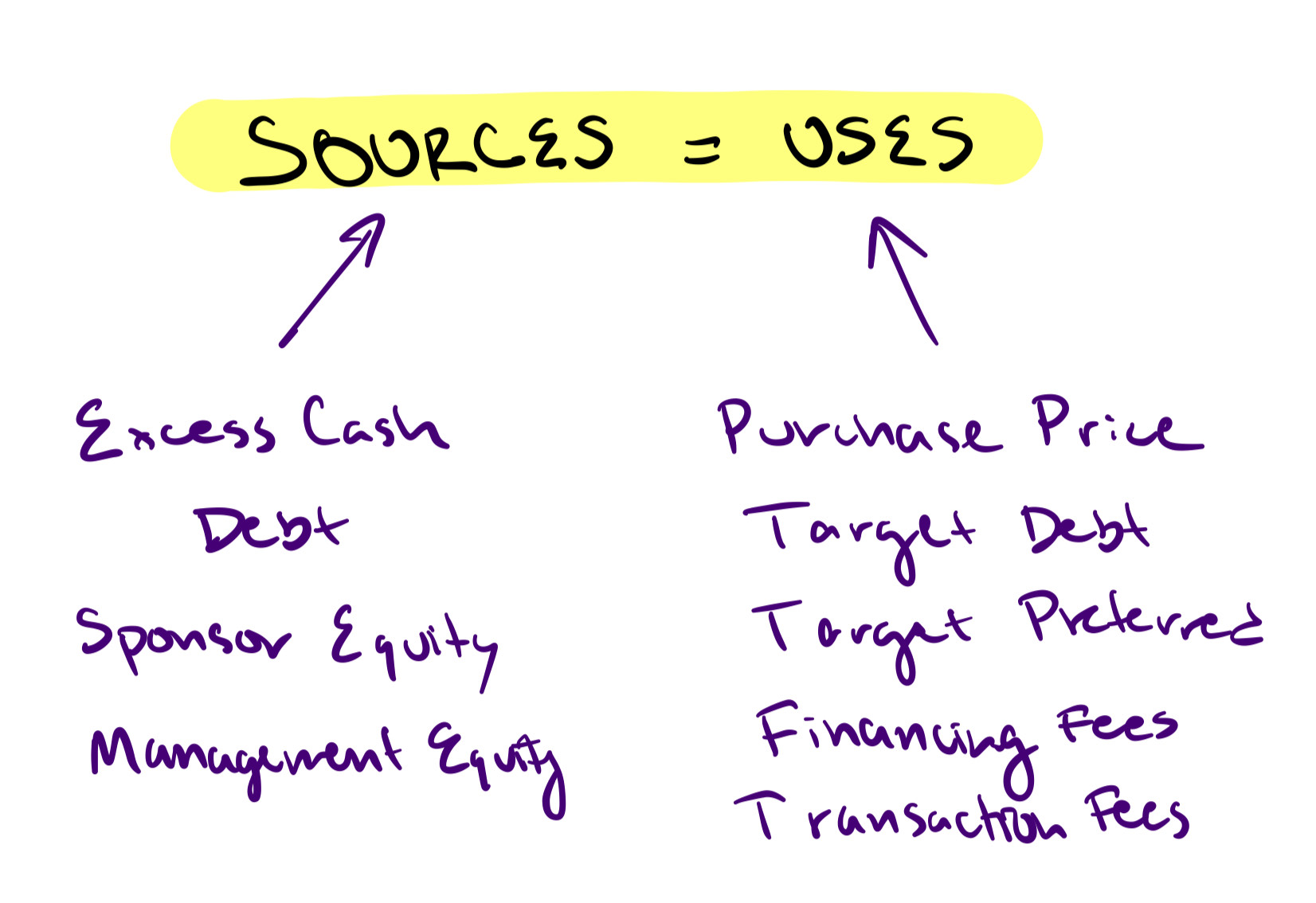

Sources and Uses

What are the sources? What are the uses? At its core, a deal is a financial transaction between two parties. If you are acquiring a company, you are exchanging capital for the business. In doing so, you need to first establish what is the amount of capital that must be transferred to the seller in order to acquire the company.

The Endless Pursuit

We are all searching for something. And, we know it’s not there. We convince ourselves that we must look a little longer. But, we know that time is limited. We convince ourselves that we must dig a little deeper. But, we know that there is only so much we need to know. Most of the answers we need, we already

Treasury Stock Method

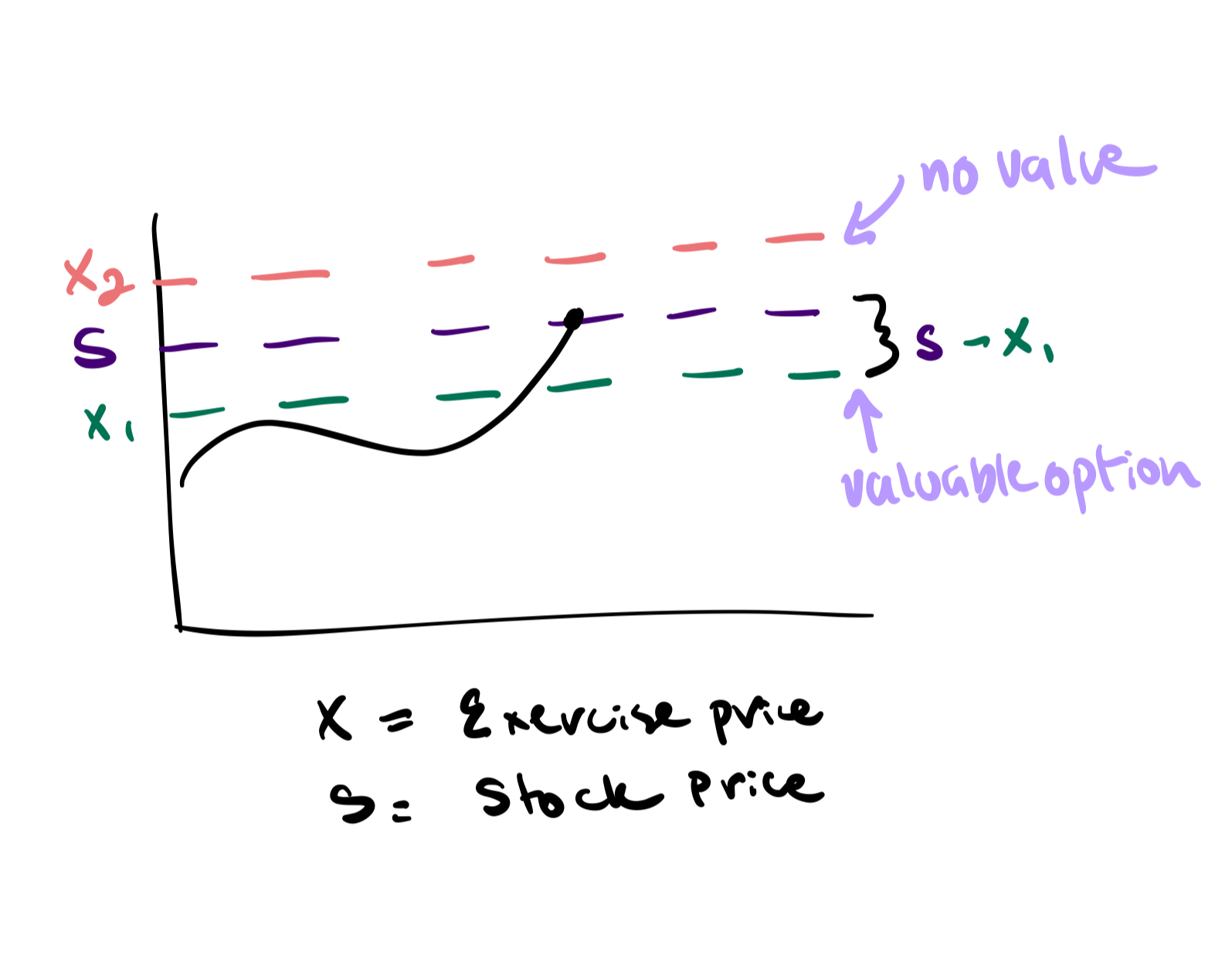

Options are not the same as shares. Many of my students think that 1 option equals 1 share. This is true on the surface. A call option gives you the right to buy a share of stock at a specified price by a given date. So, if you work for DropoutEdu and were granted 1 at-the-money option that expires in

Why Not Just Exercise the Option?

An option gives us the right to convert into shares. So, why don’t we always exercise that right? Say we owned Tesla options. Who doesn’t want shares of Tesla? Well, like everything in finance. It depends on the price. If the price is not right, it may not make sense to exercise the option. By exercise, we mean take the

Minute Markets 4/17/24

Key Events 👉 Microsoft invests $1.5B minority stake in G42 Microsoft’s investment is seen as a move to strengthen US interests in the global AI sector, potentially countering China’s growing influence. G42 is an Emirati AI company that provides digital infrastructure and cloud computing services. Previously, the company used Chinese hardware to operate their systems. Following the deal, G42 will

The Attractive but Unimplementable

A few days ago, I was listening to a podcast with Howard Marks. Howard Marks is the billionaire co-founder and investor behind Oaktree Capital, which manages ~$189bn of assets primarily known for their complex credit investing strategies. Howard has been writing since the early 90s. Similar to Buffett (who has been writing since the 60s). He writes at least quarterly

Shorter, Shorter, and Shorter Feedback Loops

We like quick feedback loops. But is this always better? Recently, I have been running into a common trend in business. Consumers value quick feedback. The most obvious example? TikTok. They have shortened each cycle to 10-20 seconds. Bored? Swipe up to the next video. Enjoying it? Watch it longer, engage with it, and then see more of those videos.

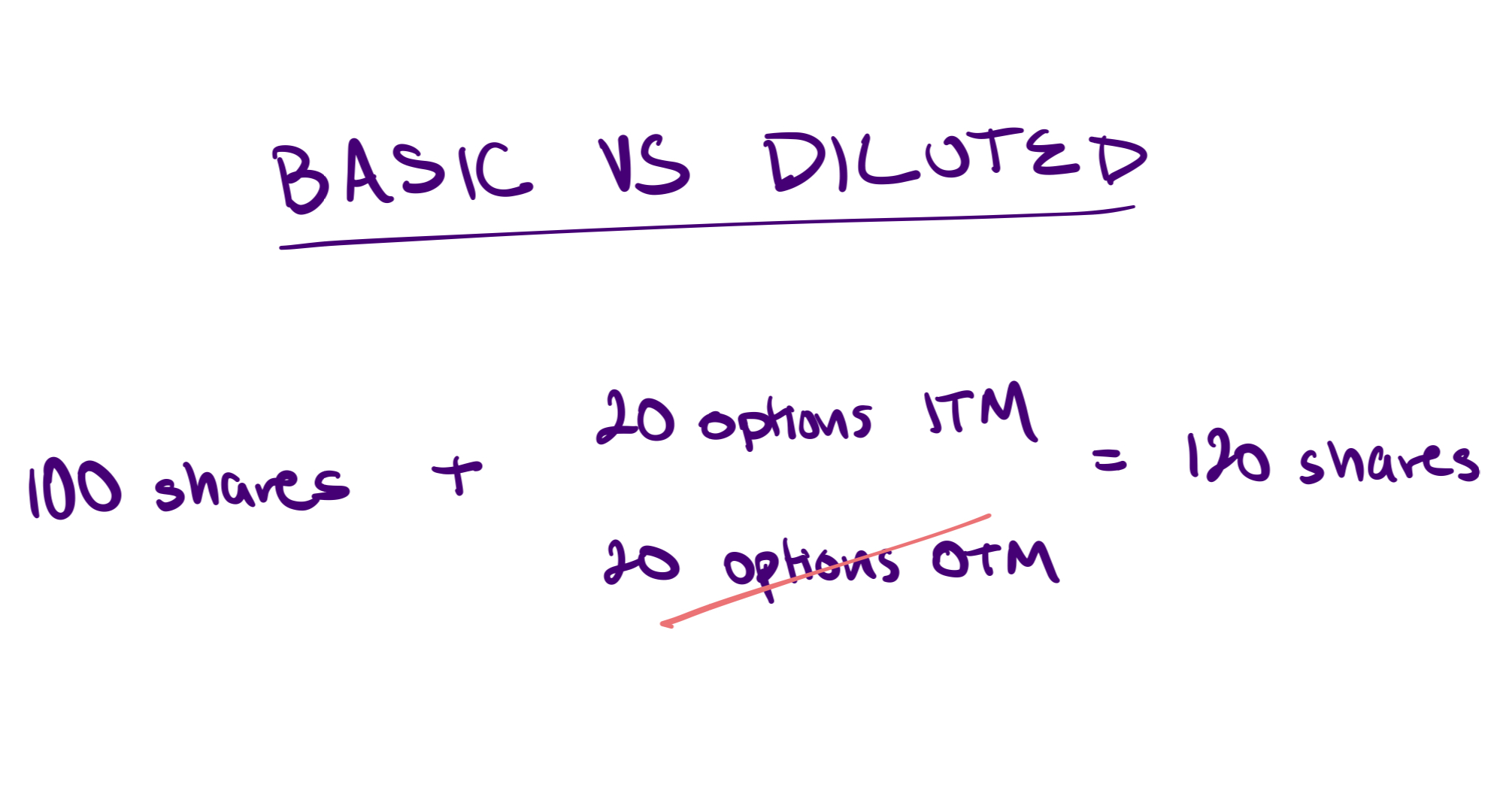

Does Basic or Diluted Matter in M&A?

Do we care about basic or diluted shares in M&A? In M&A, the acquirer (buyer) is attempting to buyout the target (seller). In order for the buyer to purchase each outstanding share in the selling company. So, if the target has 100 shares, the buyer would need to buyout the entire 100 shares to acquire 100% of the company. But,

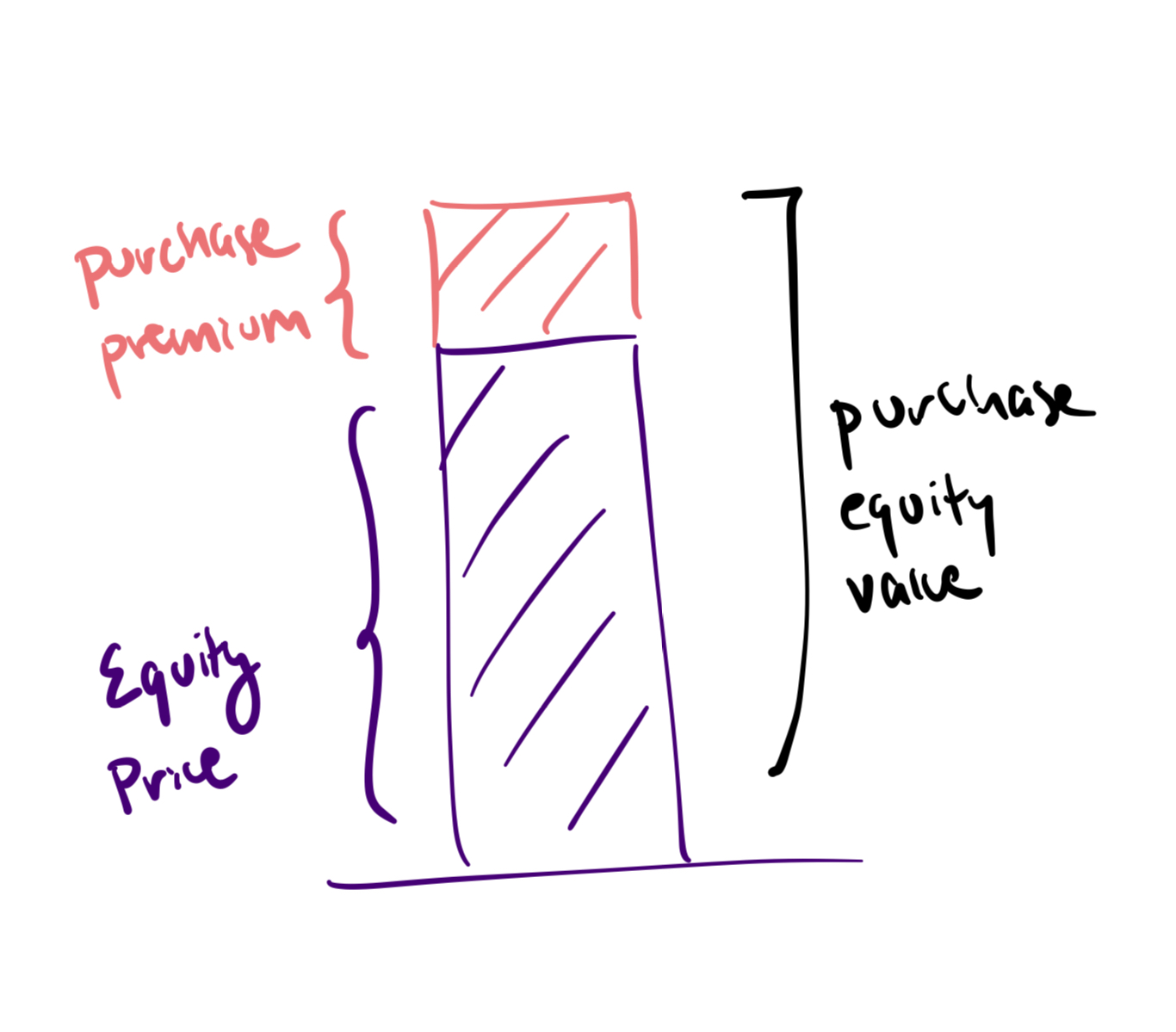

Is Purchase Equity Value Not Equity Value?

What makes purchase equity value different from equity value? Equity value is also known as market capitalization. It is share prices x shares outstanding. Purchase equity value is different from that. It has to do with the value that is attributed to equity investors in a case where the company was being acquired. The acquirer will offer to purchase the

Why Does Share Price Slide on Deal Announcement?

Why would shares slide on the announcement of an M&A deal? Maybe, the deal is dilutive. What do we mean by dilutive? It means that whatever metric we use to benchmark the deal performance is falling after the transaction occurs. The metric we often use in M&A is EPS so see the short-term implications of the transaction. So, if the