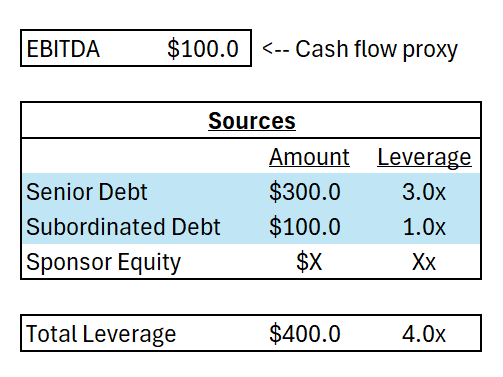

How Sponsors Think About Leverage

The goal for private equity firms is often to take on the greatest amount of leverage that the company can handle. By handle, this means that the company should have enough cash flows to service any interest and principal repayments and then some in case things don’t go as planned. Sponsors think about the maximal amount of debt by projecting

Life’s all Relative

When we think about life. Life is all relative. There are very few things in this world where the absolutes matter. I am a better investor – because I beat the markets by 1%.I am a better cook – because my family likes my food more than eating out.I am fitter – because I can run, swim, and bike more

Financing Fees in LBOs

How should we treat financing fees in an LBO? Financing fees are any upfront costs associated with issuing new money. Typically, whenever companies issue new debt, they must pay the lender a commitment fee of 0.25% to 2%. Even the financial sponsor may charge fees on total sources less fees in contributing capital to close the deal and organizing the

Hidden Costs of Debt

Is interest the only cost of issuing debt? No. Interest is important as both the lender and borrower. But, lenders have other ways to increase their returns. Aka other fees. One such fee is the commitment fee. This fee ranges from 0.25% to 2% of the loan amount. So, if you were to take on a loan of $100M, you

You Think You Made It. When You Realize You Didn’t.

You think you made it, and that’s when you realize you haven’t. This defines much of my life. And, maybe even yours. If you are a competitive person. I am always seeking new opportunities. When I was in grade school, I wanted to get the best SAT score. When I got the SAT score, I wanted to write the best

Question of the Day 4/20

Question When does an item show up on the income statement? A) The revenue or expense recognized or incurred in the period listed on the statement. B) When the cash is transferred from one party to another. C) Earnings to equity investors are affected. D) When cash is expected to be transferred from one party to another. Answer Answer: A

Why do Distressed Companies Take on New Debt?

Distressed companies are distressed because they are unable to meet their covenants, or rules placed by lenders, on their debt obligations. For some companies, this can be because they overlevered and do not have the ability to have their operations cover their interest on debt. If this is the case, the company must restructure itself. Financially and/or operationally. Often, companies

Purchase and Trading Multiples

Purchase Multiples versus trading multiples. What’s the difference? Trading multiples represent the firm’s current market value relative to a metric. The market value could be either that of the firm (market enterprise value) or that of equity (market value of equity). The metric could be anything that is correlated to the firm’s ability to generate cash flows. For example, if

Winning is Not About You. It’s About Them.

Winning a conversation is not about getting what you want – it’s about making the other person feel heard. Yesterday, a friend told me about his interaction with his coach. After a weekend competition, driving back to Ann Arbor the team wanted to get dinner. They had competed hard the past 3 days and were exhausted. But, the coach did

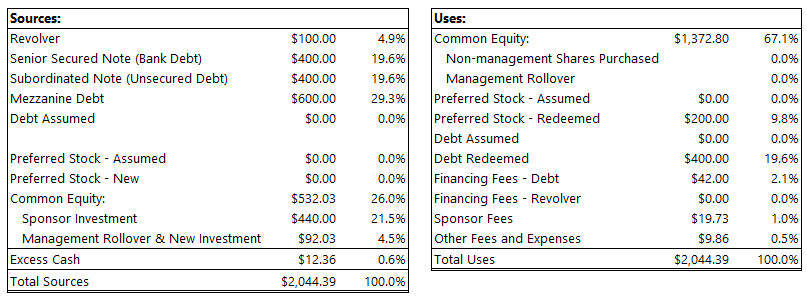

Sources and Uses. What’s the Buzz?

Why do we need a Sources & Uses schedule? In an LBO, the schedule is the basis of the new capital structure of the pro-forma company (post-LBO). The capitalization of the business will change depending on how much leverage the private equity firm decides to put on the company to close the deal. The S&U schedule will indicate the sponsor