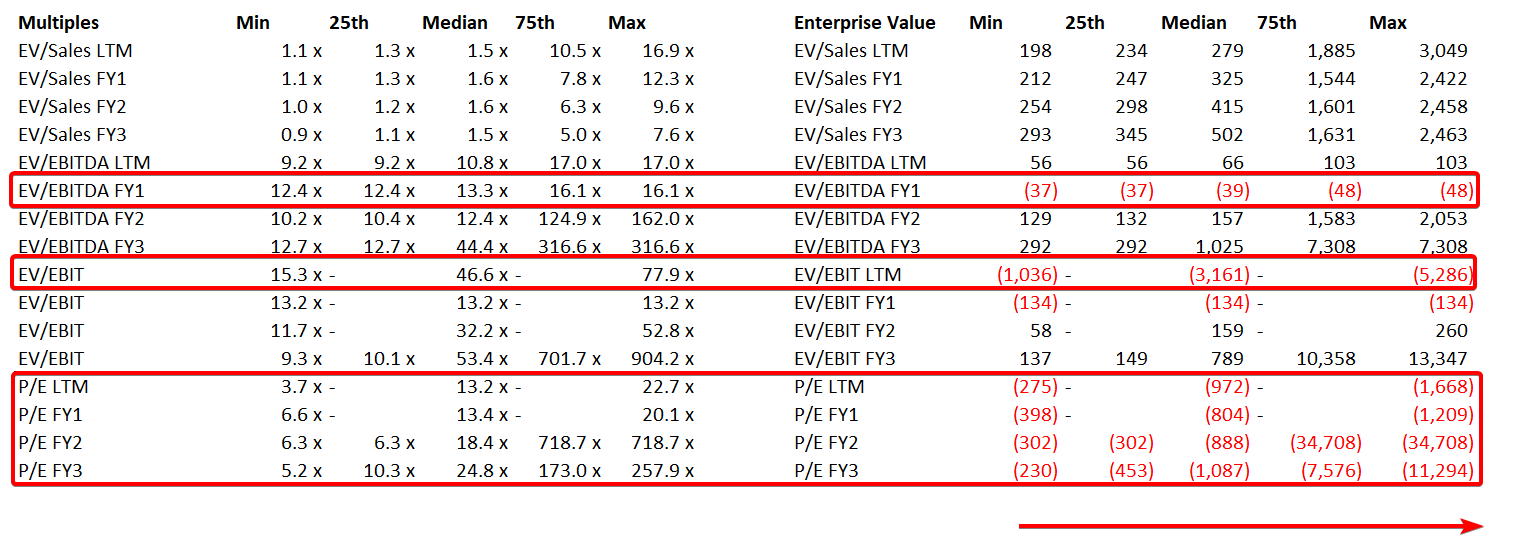

Why are negative multiples not meaningful?

A valuation multiple is a ratio that measures price paid per unit. The numerator is often a total value metric such as enterprise value or equity value. The denominator is some financial metric. The benefit of valuation multiples, as with any ratio, is that it expresses price in relative terms, allowing us to compare companies irrespective of size, but on

Be a Missionary Not a Mercenary.

This past week I was invited to speak to high school students at Lakeland High School and Skyline High School where I spoke about building a business, qualities of success, and college admissions. It was a great experience that brought me back to my roots, where I spent thousands of hours coaching high school students looking to break into top

Get Comfortable doing the Uncomfortable

#1 PageRank on Google! This past Friday, my website ranked first on Google search results. While routinely logging in to edit the backend of my website, I accidentally hit the name rather than the URL on Google. To my surprise, the website I tirelessly built from the ground up each day over this past year ranked first place. What were

Negative Earnings Per Share

Why can negative earnings per share (EPS) be misleading? Recently, I was discussing anti-dilutive effects on a student’s financial model. This problem arises for companies that have negative EPS. EPS is defined as Net Income to Common/Shares Outstanding. Because companies cannot have a negative amount of shares outstanding, the only way to have negative EPS is by operating at a

Weighted Average Shares Outstanding

Why do companies use weighted average count as opposed to the ending diluted share count? Remember that the income statement reflects a period of time. Over the period of time the number of shares outstanding can fluctuate for a variety of reasons related to share buybacks, share issuances, and dilution. In these cases, simply using the diluted share count at

Levers Behind Margin Expansion

A continued focus on efficient, sustainable business profitability. As earnings season progresses, I was looking at some of the top movers, including Bel Fuse, an electrical components manufacturer. Shares are trading up 23% post-earnings release, reflecting the increased profitability stemming from gross margin expansion. Bel Fuse is a multifaceted company specializing in three core product segments. In Power Solutions and

Q3 M&A Activity Update

A quick note on Q3 M&A activity: In Q3 2023, the global M&A market experienced a significant decline, with only 8,775 deals announced worldwide. This represents a 28.3% decrease compared to the same period in the previous year. Notably, it marked the first time since the pandemic that the number of global M&A announcements fell below 10,000. During the same

Don’t Forget the Non-quantifiable

“We can’t measure the impact. That’s exactly why it’s our values. Our values are that we do something that nobody notices and we can’t measure. We do it because that’s what we believe.” In a recent interview with one of my favorite CEOs, Airbnb’s Brian Chesky, I recollected an experience I had two summers ago during my time at Rocket

Treasury Bond Drawdowns

Threw together a drawdown chart, look at recent drawdown levels on long-dated treasury bonds. What is a drawdown chart? Effectively, the chart shows the peak-to-trough decline in the value of an investment or trading account over a specific period. It is used in finance to analyze the performance and risk associated with investments. Through the graph, you can see how

There’s no Hard Rules

While we like hard rules, there are often no hard rules in finance. Everything must be viewed on a case-by-case basis. Especially when it comes to working capital, as I have been discussing. This weekend, I was running quant screens to identify potential value names, more to come, and when I pre-maturely screened for names, an interesting thought came up.