Being naive is our superpower (as young people)

Being naive might be our superpower (as young people). Whenever we want to start anything, we probably want to do that thing well. Being experienced means that we need to find all the answers to start our business. But, being naive means that we overlook the struggles and pains. We get started. The starting helps us to answer those questions.

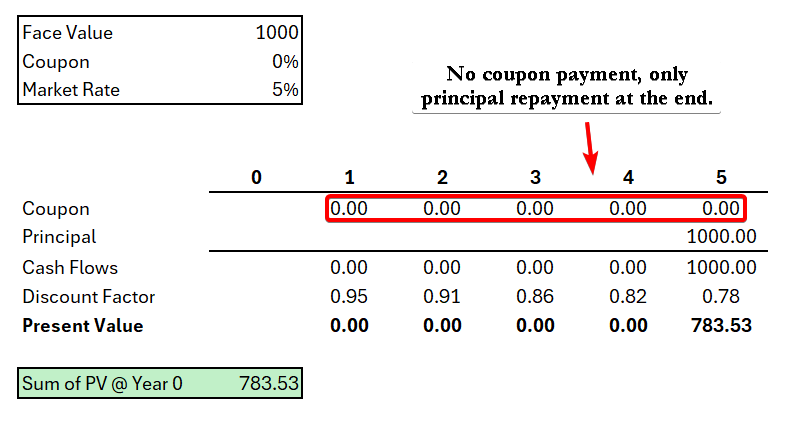

Zero-Coupon Bonds? Count me out…

Would you ever lend me money for free? And charge no interest. Probably not. Well, maybe, if you are my friend. But, it’s unlikely that you would lend money for nothing in return. Why? Well there is risk that stems from the uncertainty on whether you will get your money back. For that risk, you ask me to compensate you.

Don’t skip to skip. Skip to win.

Don’t skip to skip. Skip to win. Yesterday, one of my buddies told me to show up to class while another one of my buddies joked about having to show up to class. Winning is all about showing up, right? Not exactly. You’re missing the point. Skipping things may seem bad. Oh, you skipped the meeting. You skipped class. You

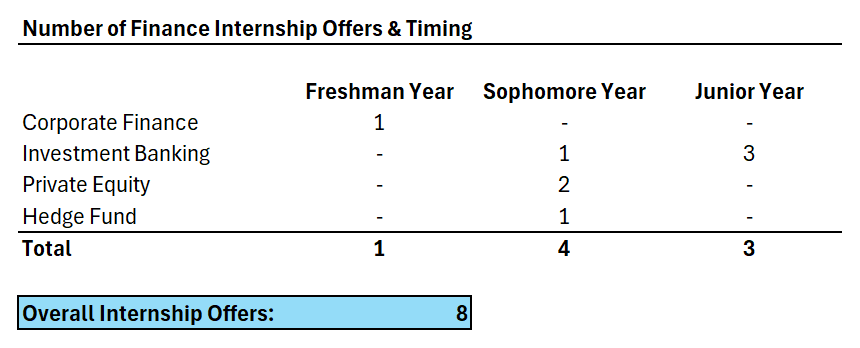

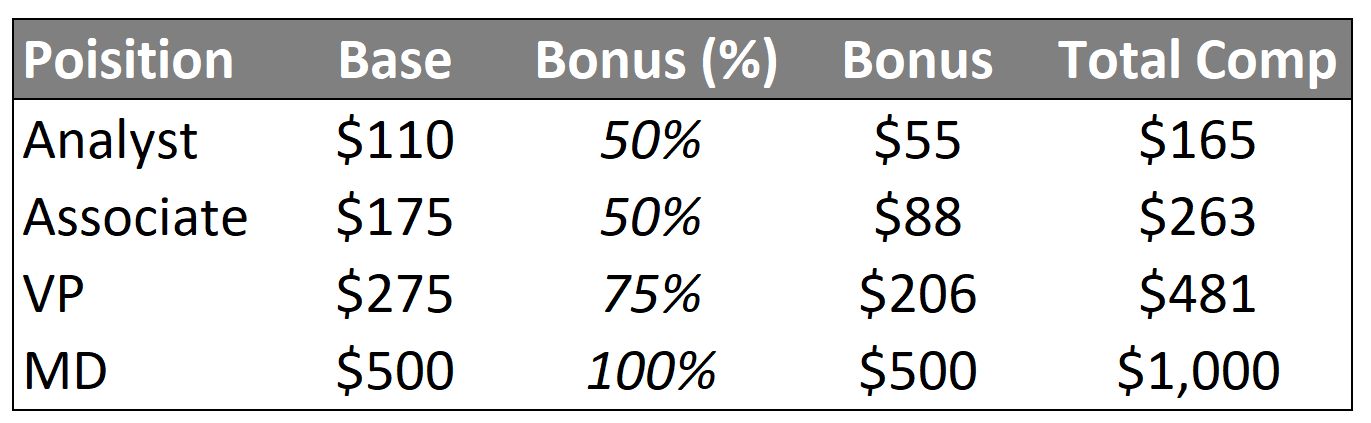

How I Landed 30 Investment Banking Interviews in College.

In this guide, I will provide you with the strategy that helped me land 8 internship offers in college, including F500 corporate finance, investment banking, private equity, and hedge fund roles. Here’s my background. In high school, I wanted to be a doctor. My whole family knew that I wanted to be a surgeon. I was shadowing

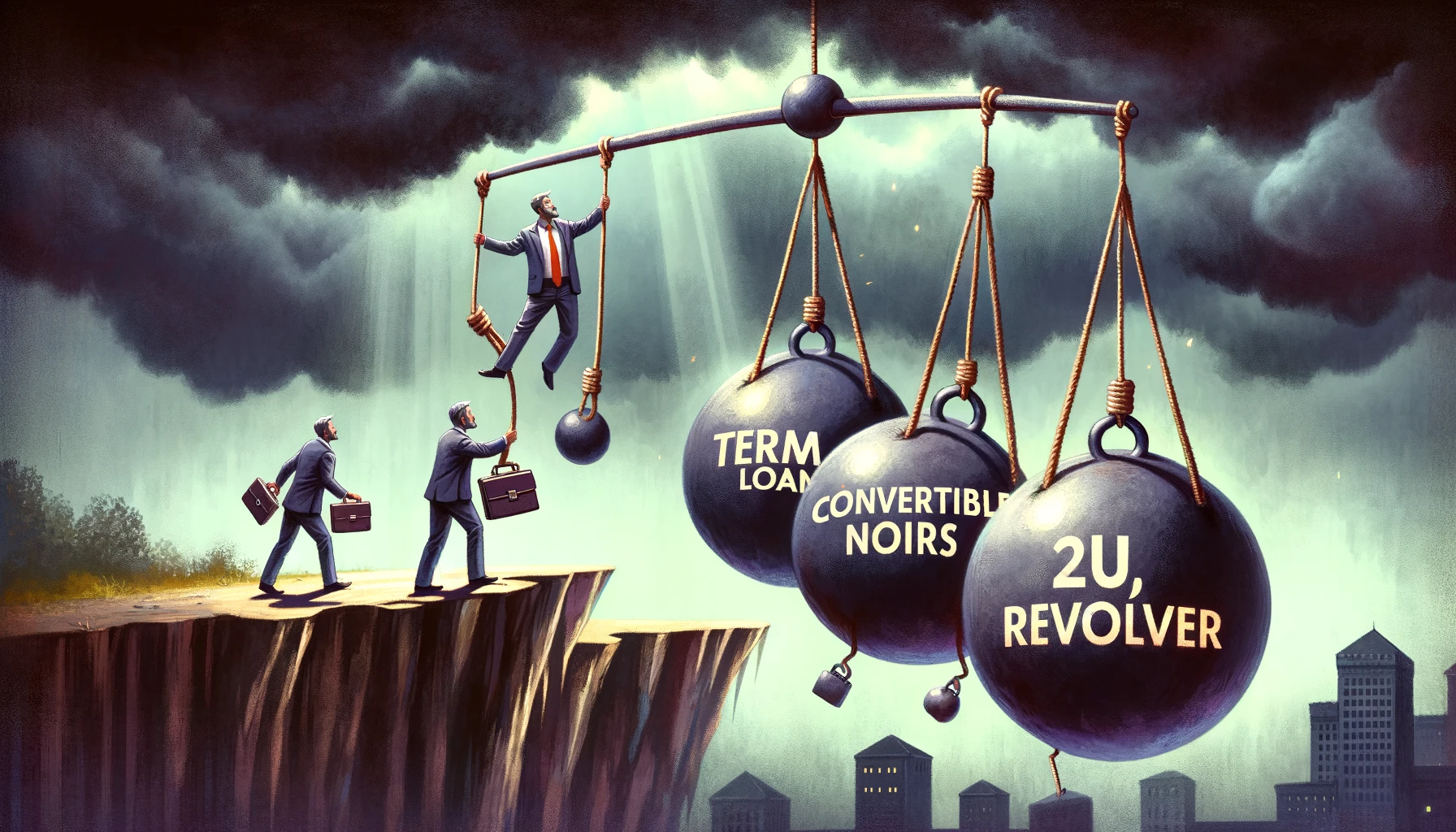

The Tragedy of Leverage Driven Growth for 2U

Part 1: Author’s Bias All valuations are biased. I must start with a simple yet profound confession. I love education. And, I love EdTech more. So, why does that matter? Well you see, when going into any analyses, it is important to consider that the analyzer, the person conducting the analysis, may have some preconceived biases. For me, I am

Maximizing Future Cash Flows not GAAP

This past week, I was invited to speak at Rochester and Huron High school about business and investing. One student asked a simple but genuine question that highlighted some of the key challenges we face when deciding to start a business. “How financially rewarding is it?” While the answer can vary greatly, I would say it’s not for the most

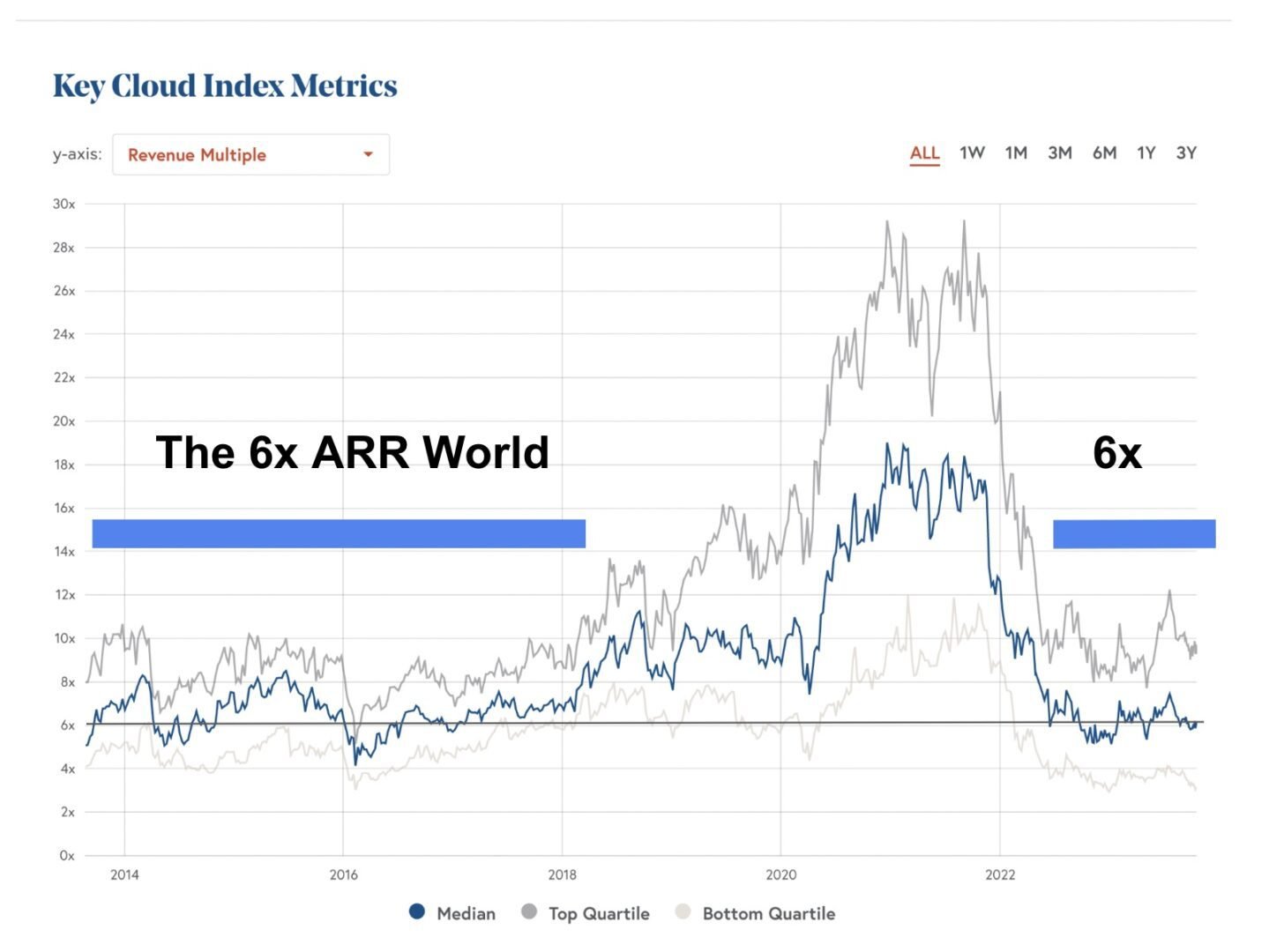

ARR Multiples Revert to Mean

Valuations for cloud-based SaaS companies have traded down to 6x ARR. What is ARR? Annual Recurring Revenue (ARR) is a metric used by companies that operate subscription-based business models. It represents the amount of predictable and recurring revenue a company expects to receive on an annual basis from its subscription customers. For instance, Peloton (PTON) in FY’23 had an ARPU