Can you Calculate IRR on Paper?

Can you calculate IRR on paper? No. Well, that is unless you are a mathematical wizard with 200+ IQ. Well, even then, it’s really not possible. While the steps can be understood, the mathematical computations are nearly impossible to do on paper. Maybe you could take the 9th root of a cash flow in year 9. OK, very impressive, but

Compounding. Discounting. What’s the difference?

Compounding is to multiplication as discounting is to division. It’s just going one way or the other. Compounding is going from value of money today (present value) to value of money some years from now (future value). Discounting is going from value of money today (present value) to value of money some years from now (future value). Take the following

Mindset Buys Skill Set.

Mindset can give you skill set – skill set does not give you mindset. There are two types of people. 1. Skilled people 2. Driven people Yes, they’re not mutually exclusive. But, it’s easy to get highly skilled and lose the mindset. It’s easier to be driven and open-minded to then go and build skills. If I do not have

Minute Markets 4/2/24

Markets Key Events 👉 February JOLTS job openings down month over month but in line with consensus. Strong job market with inflation reduction is ideal. Market is awaiting Non-farm Payroll (NFP) this Friday on March employment numbers. Consensus +200k increase. Still more data is needed to convince fed officials of the timing of the rate drop. Continued debate on June rate-cut prospects.

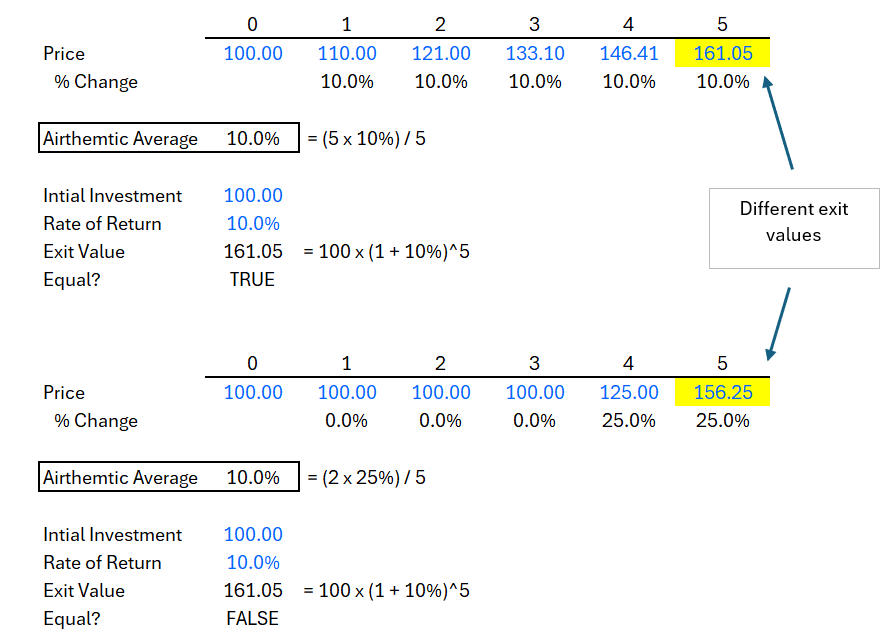

Arithmetic versus Geometric Returns?

What’s the difference between arithmetic and geometric returns? Arithmetic returns are straightforward to calculate. Add up the returns for each period and divide by the number of periods. They are commonly used for simple return calculations. In case 1 and case 2, we can see the arithmetic mean under constant 10% returns and 25% over the last 2 years, both

Why is my IRR calculation calculation off?

Why is my IRR calculation outputting a different number than expected? In simple terms, IRR is the average return over a period of time on an investment. Say the value of our investment increases by exactly 10% each year for 5 years. In this case, the average return is fairly straightforward. It averages to 10%. IRR = 10% The exit

Time flies doing hard stuff.

When I work with deadlines, I get lost in my work. When I have other people relying on my work, I feel a sense of responsibility. Putting two and two together is my winning combo to get stuff done. Urgency + accountability = Quality, timely work. These past few days have been busy business wise. We are upping our newsletter

4/2 Question of the Day

How does the market typically value companies? A) Based on near-term earnings B) Based on long-term earnings C) Based on near-term cash flows D) Based on long-term cash flows Check Answer

Agency Theory

Your management is not working in your favor. Say you’re the CFO. First, congratulations. You made it! Investment Banking. Business school. Private Equity. All paid off. Call your parents, they will be proud. Next, what do you care about? Your new pay package. Those sweet bonuses are hard to take your eyes off. Millions of dollars – it’s a big

Premium Bonds

Would you lend more than you are paid back? Probably not. But investors do this often. If a bond returns $1,000 to their bond investors, why would investors purchase the bond for more than $1,000. Doesn’t that mean that the investor is guaranteed to lose money. Not exactly. So, why exactly do a company’s bonds trade above the face value?