Valuations for cloud-based SaaS companies have traded down to 6x ARR.

What is ARR?

Annual Recurring Revenue (ARR) is a metric used by companies that operate subscription-based business models. It represents the amount of predictable and recurring revenue a company expects to receive on an annual basis from its subscription customers.

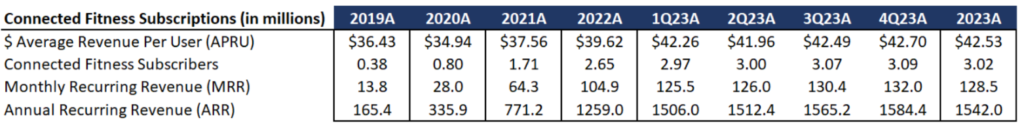

For instance, Peloton (PTON) in FY’23 had an ARPU (average revenue per user) of $42.53. At ~3mm subscribers, that generates $128mm MRR (monthly recurring revenue). Taking MRR x 12, we get that Peleton’s ARR is $1,542mm in its most recent fiscal year.

Investors like to value SaaS (software as a service) companies based on ARR because it is often sticky, aka predictable because of its recurring nature. This is often viewed as more favorable relative to its one-time sale counterpart which may have a lower CLV (customer lifetime value) and lower margins.

Why did multiples exponentiate before crashing? Many reasons. One, access to easy money was plentiful with interest rates being at near zero levels. This was amplified by the “crowd into seed.” There was an increase in later stage funds piling in capital to seed rounds for a variety of reasons. (i) The incentive of VC investors is to deploy capital, not always make money. Investors have to spend their time speaking to founders and finding deals, as the late stages dry up, they look up the line. Investors are paid to deploy capital, not sit around. Aggressive deployment of capital worked when the VC factory was “in production” and growth was formulaic. More VC dollars chasing a smaller space, quickly drives up the price paid to do deals.

Between 2020-22, cloud-based SaaS companies were being closed at 10x ARR at the median. But as of recent, we are beginning to see mean reversion back to the 5-6x ARR range as suggested by data from @SaaStr.