Are there antitrust concerns that arise from index fund managers?

There are the big three.

Vanguard

State Street

BlackRock

They are by far the largest passive investors.

Look, they own almost 5-15% in every public company through the indices they provide investors.

It’s simple. They create indices.

These indices are passive funds, meaning that they are not actively involved in managing the fund performance.

Often, they are attempting to track a certain benchmark.

The closer they track the benchmark, the better.

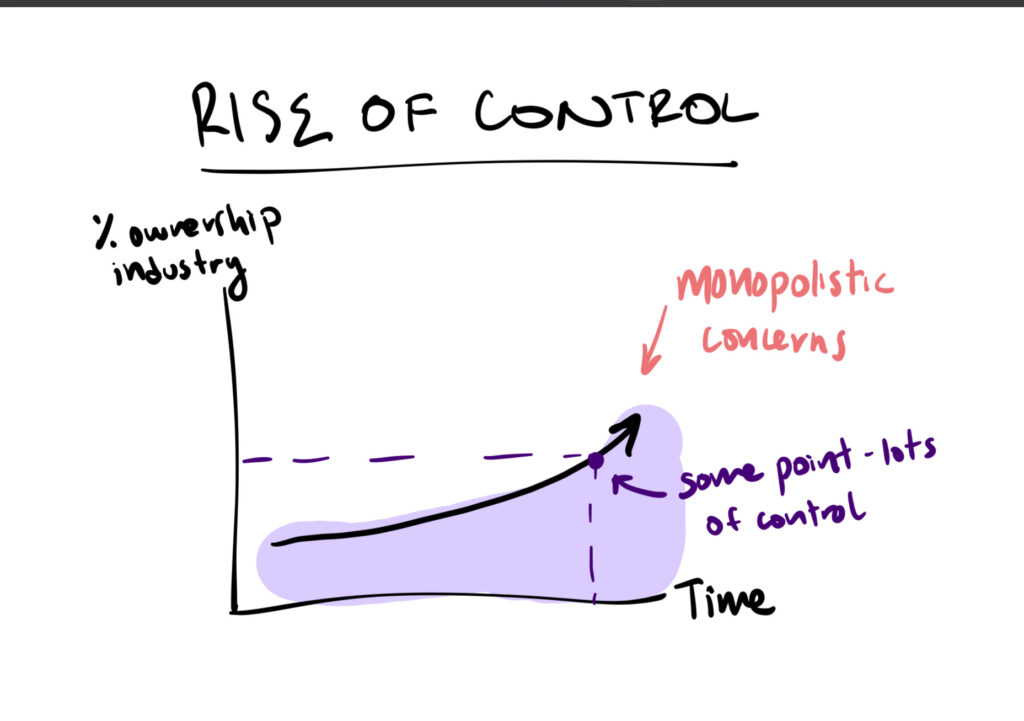

But, with the rise of index funds, their concentration in publicly traded companies has only increased.

What happens when you are the largest shareholder?

You often have more influence on the board.

Even though these asset managers have a minority position in most public companies, they are still the largest shareholders in most of them.

So, what’s the risk?

Well, if you own a good chunk of each public company, you benefit from all of them doing well.

So, if you exert control over your investments, what would you do as the fund manager?

You would tell all your companies to raise prices.

Cutting prices would only create unnecessary competition.

If you own a sizable portion of each company in the industry, you would be losing out on profits by reducing prices.

Essentially, you would have your own portfolio companies competing against one another, hurting your portfolio’s profitability and value.

This can result in price fixing if the passive investor goes active and pushes management to hike prices of good and services across the board.

This stifles competition. Be bueno.

So, the question of concern here is are the big 3 becoming more so active managers.

At the end of the day, they have a fiduciary duty to their investors. That is, they must act in the best interest of their investors.

That might mean influencing the board in some cases.

Bottom-line? The line between passive and active is changing given the influence these index funds now hold. This can create a new layer of antitrust concerns that did not exist prior.