Your management is not working in your favor.

Say you’re the CFO.

First, congratulations. You made it! Investment Banking. Business school. Private Equity. All paid off.

Call your parents, they will be proud.

Next, what do you care about? Your new pay package. Those sweet bonuses are hard to take your eyes off. Millions of dollars – it’s a big deal.

Majority of your compensation will come from performance bonuses. As a result, you have a laser sharp focus on hitting your KPIs.

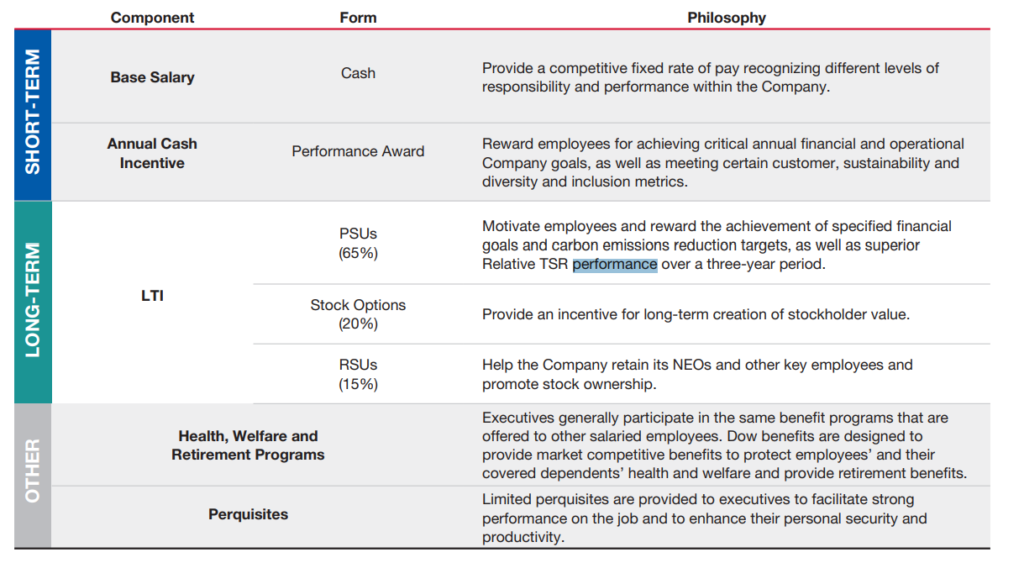

All public companies have executive compensation companies that determine the pay structure of key executives in order to make sure that incentives are aligned with the company’s shareholders.

This information can be accessed in a company’s annual proxy statement (DEF 14A).

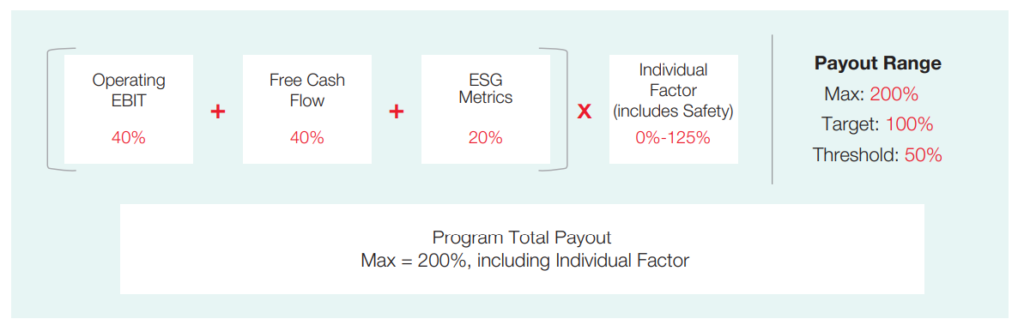

In the case of Dow Chemicals, we can see that management is compensated on 3 primary factors.

– Operating EBIT

– Free Cash Flow

– ESG

For Operating EBIT and Free Cash Flow there are distinct ranges that the executives need to hit in order to unlock certain percentage payouts.

For ESG, there are 3 areas and metrics that are tracked to determine the percent payout.

As the manager, you are not incentivized to do anything in your power to hit those targets.

This may come at the expense of several things:

– Excessive risk taking to meet short-term financial targets, potentially compromising the company’s stability and reputation.

– Focus on optimizing short-term cash generation over optimizing the overall cost of capital and financial health.

– Boost immediate profitability by realizing gains, controlling purchase decisions, adjusting estimates, etc.

This is known as agency theory.

And, there can be steep costs associated with it.

Agents (you, the executive) have different goals and incentives than principals (shareholders), conflicts of interest can arise.

For example, managers may prioritize their own interests, such as job security or maximizing their compensation, over the interests of shareholders, leading to agency costs.

Selling equipment investments or assets more broadly may result in a gain today, but it could hinder future company performance.

Cutting headcount today could result in reduced resources to continue to innovate and develop that could cause your company to lose market share over the long-term.

Cutting back growth investments can also hinder innovation, stifling growth. Etc.

Bottom-line? There is no perfect compensation structure or contract because we, as managers, will always work in the direction of our economic incentive.