This past week, I was invited to speak at Rochester and Huron High school about business and investing. One student asked a simple but genuine question that highlighted some of the key challenges we face when deciding to start a business.

“How financially rewarding is it?”

While the answer can vary greatly, I would say it’s not for the most part. Both from personal experience and observing other founders. Take myself, I started formally working in the education industry 5 years ago in 2018. At the start of any career, the money is small, but relatively speaking, it’s the most money you will need, and that’s how I felt. As I switched roles and began to invest more time into the company, I began to see increased responsibility, leadership, autonomy and with that compensation.

As I invested thousands of hours, it became even more formulaic: work another hour, get paid another hour’s worth. You had me addicted. During peak season, I would have days I would record for 20 hours straight only stopping for two hot pockets or three beefy burritos and some nights coffee. Unhealthy, sure, but I didn’t mind! I liked what I was doing anyway.

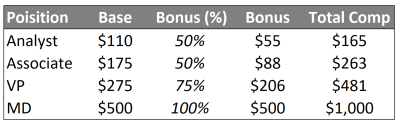

Take an example of investment banking salaries. As a first year, you could be comping $150k out of college. That is very hard to replicate in most businesses in year one of operations. That is the equivalent of demanding $12k the first month when you haven’t even finalized a business idea. And even if you generate a strong amount in profit, you may only have a small distribution because of the significant reinvestment in the form of working capital and CapEx required to continue to (i) operate and (ii) grow the business.

It becomes very difficult to leave a gig that pays the bills and more, to start some lousy business that requires nothing but time and capital. Going from anything more than $50/hour to not getting paid by the hour is one of the hardest things to do. It only becomes harder as your level of responsibilities in life increase: relationships, kids, mortgage, health insurance, etc. So starting early may be the only best solution. But often, older more experienced working professionals tell me that they want to save a nest egg to fund the business. 2 questions: (i) when is any amount of initial capital ever enough and (ii) will you put behind the comfy, cushiony 6-figure job to risk it all. Truthfully speaking, I barely could.

Starting a business is unforgiving. This notion of work another hour, get paid another hour’s worth does not hold up. Each hour I began to invest was not directly adding up to earned revenue. It was building some sort of intangible goodwill that I hoped would turn into a more tangible substance later. But that later was undefined and unspecified.

This is exactly what will hold back most aspiring entrepreneurs. There is simply no way to beat the 9-5 job, which provides a comfy, cushiony cash flow (“CCCF”). Not all entrepreneurs get CCCF. Often their wealth is paper wealth. Asset rich but cash poor. This is a common problem that most tech entrepreneurs face today. Their wealth is tied up in assets, aka businesses, that are not profitable. While good in theory because as the business increases in value so does your net worth, this also means they have no immediate liquidity. Therefore, every action they take can be life or death.

Take for instance, Zoom Info. Founder & CEO Henry Shuck “raised the business with no outside funding for 7 years, growing to 25mm in ARR, and in 2014 they took their first outside funding, which funded the business and provided secondary dollars that took the pressure off their entire net worth and future being tied to the business, which makes for much less optimal decisions in such situations.” It is in such liquidity events where founders have the ability to convert ownership into cash, making their earnings tangible and not as volatile.

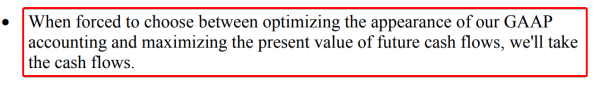

A final take home is seen in Jeff Bezos’ 1997 Shareholder letter. One of his key tenets is as follows…

Bezos’ has pioneered the modern way for innovative companies to engage shareholders through visionary storytelling. Part of building a great company is building for the future. Building for the future may mean operating at a loss today, which Amazon and most growth companies define the norm in order to maximize long-term shareholder value. The short-term is often not the financially attractive part of the journey.

Building a business is like growing an apple tree. The tree grows as it’s watered, but it only starts to yield fruit after years of nurturing.