The Basics

- Calendar Year (CY): The standard twelve-month period that begins on January 1st and ends on December 31st of the same year.

- Fiscal Year (FY): A twelve-month accounting period that a business or organization chooses for financial reporting purposes. It does not necessarily align with the calendar year.

What is Calendarization?

Calendarization is a financial process that involves converting financial data from a non-calendar fiscal year or reporting period into a calendar fiscal year or reporting period. It aligns financial information with the conventional twelve-month calendar year, which runs from January 1st to December 31st.

When do We Need to Calendarization in Finance?

This would be fine if we are analyzing two companies that have identical fiscal year reporting standards. In our example, if both companies end their fiscal year on April 30th, then we could draw comparisons as the financials will be pulled from the same time period.

However, in financial analysis, we are often looking to compare the financial data of one company to a set of other comparable companies in that industry. Therefore, it is common that we see companies with different fiscal year reporting. In such cases, we must standardize the reporting periods to match the calendar year in a process referred to as calendarization for comparability purposes.

How to Calendarize Financials

- Gather financial data for one extra year to adjust to the calendar year.

- Determine the Company’s current fiscal year end.

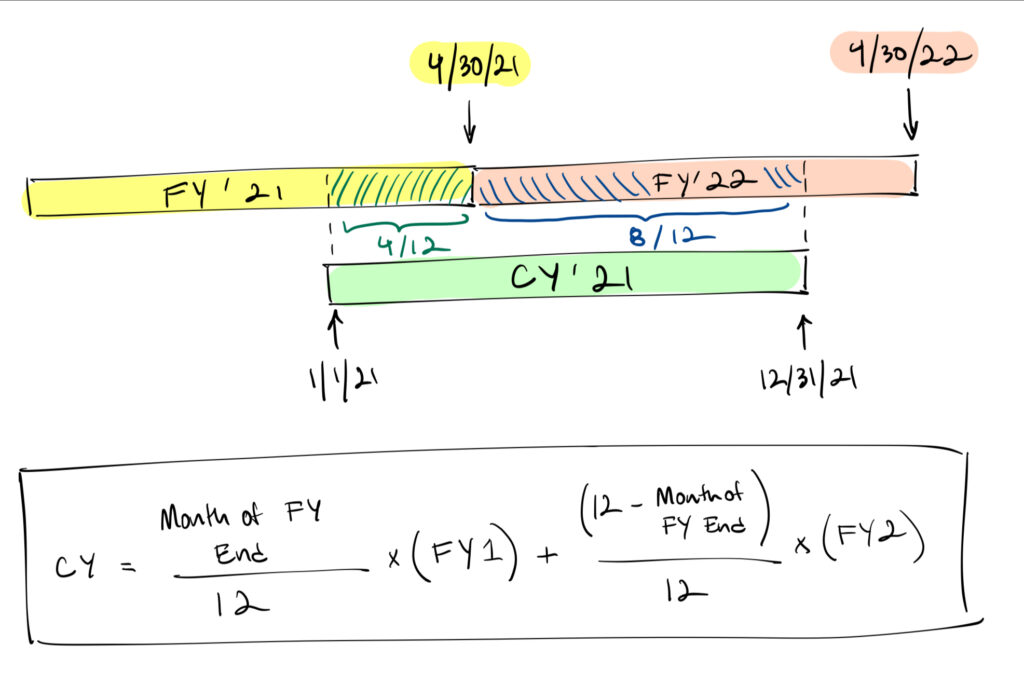

- Take the month the fiscal year ends in, divide it by 12, and multiply it by the metric being converted.

- Calculate 12 minus the month the fiscal year ends in, divide it by 12, and multiply it by the metric being converted.

- Sum together the result from steps 3 & 4 to get the calendarized value.

Why is Calendarization Important

Standardization: It allows for the standardization of financial data, making it easier to compare financial information across different companies, industries, and timeframes. This is particularly important for investors, analysts, and other stakeholders who need to make informed decisions based on financial data.

Consistency: Calendarizing financial data ensures consistency in reporting. It eliminates the confusion that can arise when comparing financial information from companies with varying fiscal year-ends, preventing misleading or incorrect conclusions.

Trend Analysis: Calendarization enables meaningful trend analysis by ensuring that financial data is reported in consistent timeframes. This is crucial for identifying patterns, assessing growth rates, and making accurate forecasts.

Regulatory Compliance: In many jurisdictions, financial reporting regulations require companies to calendarize their financial statements. This ensures compliance with reporting standards and facilitates auditing processes.

Comparative Analysis: Investors and analysts often need to compare a company’s financial performance with that of its competitors or industry benchmarks. Calendarization makes such comparisons possible by aligning different companies’ financial data on a common calendar basis.

Examples of Calendarization

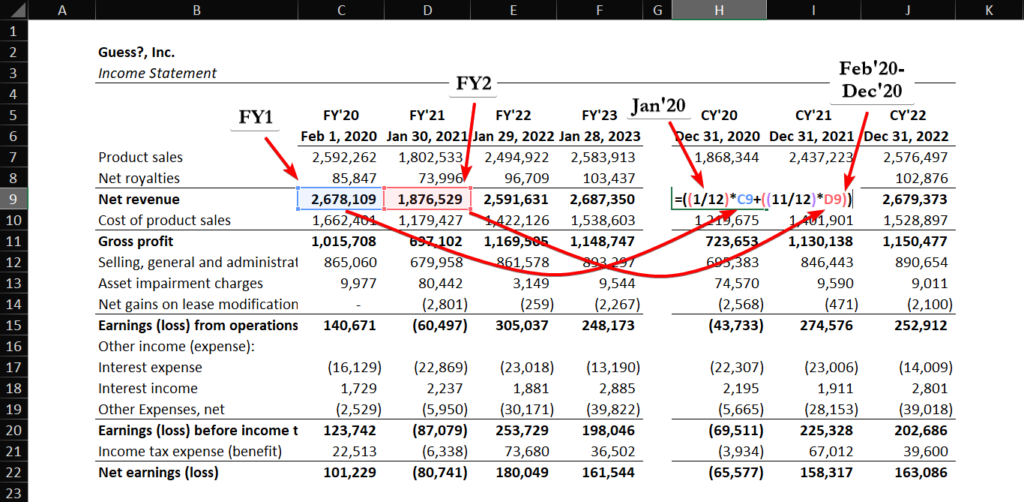

Then, we add weighted average of that month to the following fiscal year. FY’21 starts on 2/2/2020 and ends on 1/30/2021. Thus, in CY’20, 11/12 months (February 2020-December 2020) are relevant to us.

By taking the weighted average, (1/12) x (FY’20 Metric) + (11/12) x (FY’21 Metric), we arrive at the calendarized financial metric.

Risks of Failing to Calendarize?

Take COVID-19, for instance. Assume that Company A had a fiscal year ending January 31st and Company B had a fiscal year ending on December 31st. Comparing Company A FY’20 financials to Company B FY’20 financials, 1/12 of Company A financials will come from 2020 whereas all (12/12) of Company B financials come from 2020. As a result, Company A will have much stronger financial performance than Company B.