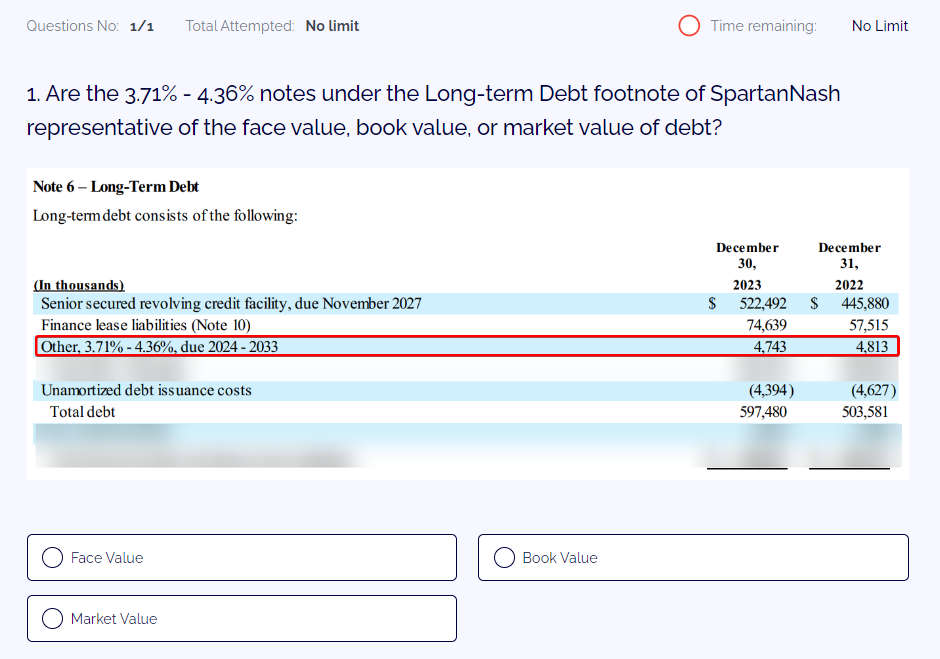

Are the 3.71% – 4.36% notes under the Long-term Debt footnote of SpartanNash representative of the face value, book value, or market value of debt?

A) Book Value

B) Face Value

C) Market Value

Answer: B) Face Value

Explanation: The total debt represents the face value of debt which is directly plugged into the company’s long-term debt balance on the balance sheet. We know this because unamortized debt issuance costs are being subtracted out of total debt.

Face Value of Debt = Book Value of Debt + Unamortized Discounts

Take a discount bond for instance, the face value will be higher than the book value at issuance. Then, over time, the issuance discount (aka cost) will be amortized. This means that the book value moves up closer to the face value of debt as that cost is amortized.

Therefore, because the unamortized portion is netted out, we go from principal (face value) to book value.

Note the market value of debt does not show up on a company’s books. The book value does.

Looking to Get Ahead in Your Banking Prep?

Our Investment Banking Accelerator is a fully live and intensive 10-week program for students looking to break into investment banking. The Accelerator provides students with all the conceptual and financial modeling skills necessary to ace banking interviews and prepare for the internship. Join us for classes starting May 25th!

We want to save you the time and stress, all while giving you a deeper finance education not offered at most schools. We focus on giving our students a highly personalized experience.