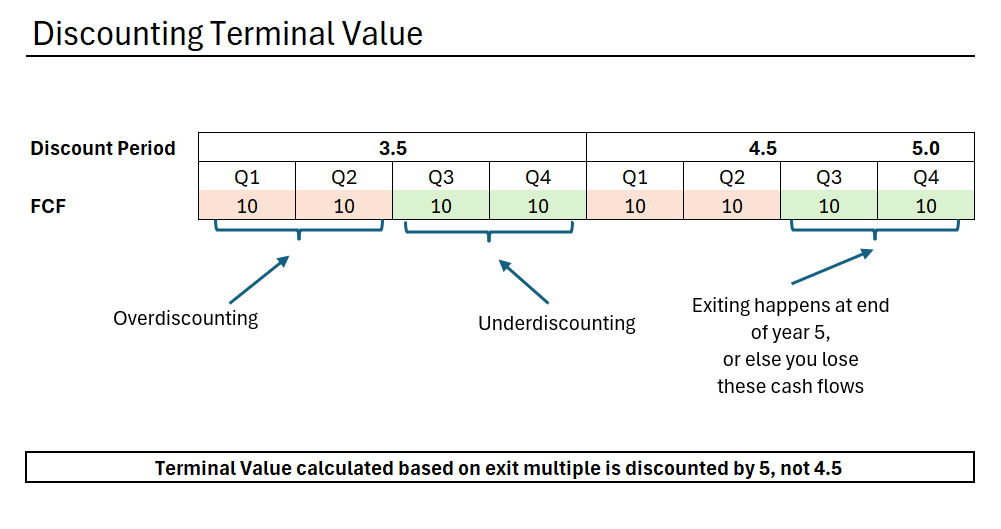

If the terminal year cash flow is discounted by 4.5 years, why would we discount the terminal value by 5 years?

There are 2 ways to determine the terminal value of a company.

- Assume a constant indefinite growth rate.

- Assume a multiple on EBITDA.

In the first case, we are implicitly projecting the growing cash flow stream indefinitely. Then, finding the present value.

In this case, it makes sense to keep using the mid-year convention. Because we are holding onto the firm and collecting cash flows indefinitely.

The mid-year convention results in us using 4.5 years as the discount period. Rather than 5 years.

But, in the case of the exit multiple approach.

We are selling the company.

We do not use a 5 year discount period because the cash flow discounted by 4.5 years is the cash flow generated over the entirety of year 5.

The mid-year formula makes it look like we receive it all by 4.5 years. But, this is to account for the over and underestimation errors.

So, the exit multiple method assumes that we sell the firm once we collect all the cash flows over the projection period. This happens to be the end of the 5 year projection period.

Bottom-line? The mid-year convention discounts by 4.5 years for 5 years of cash flows. So, when determining the terminal value based on the exit multiple approach, we discount by 5 years.