If Apple had a massive investment in WeWork debt, what would happen? Given that WeWork just exited chapter 11.

The underlying question–

How do unrealized gains or losses affect the financial statements?

Well, I would hope that Apple was more sophisticated than me. And did not get carried away in the WeWork hype.

So, say, the WeWork debt is still on their balance sheet. Listed under marketable securities.

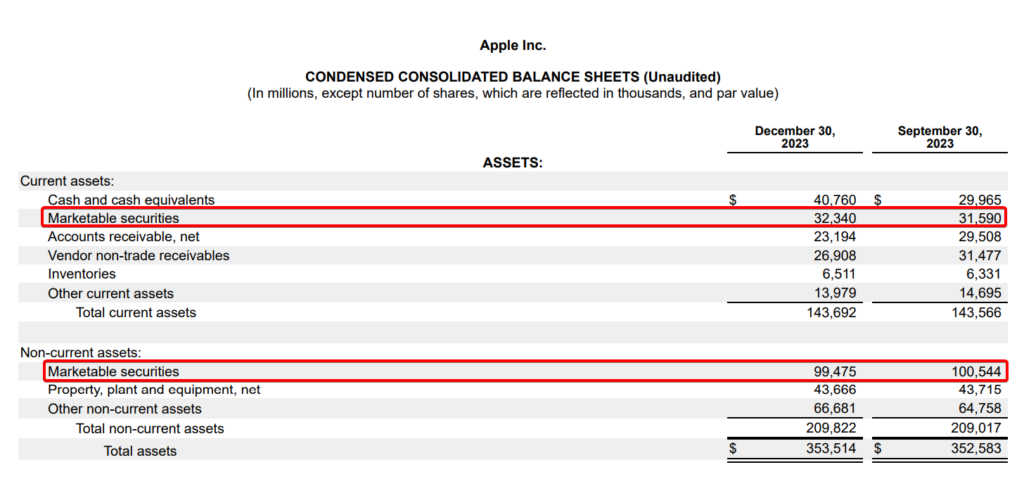

Which Apple does have ~$130B in marketable securities on its balance sheet.

These include assets that the firm expects to sell within 1 year (current) and hold for longer than 1 year (noncurrent). They are any securities that trade on a public market.

Apple would need to categorize these assets as either available-for-sale (AFS) or held-for-trading (trading).

Trading securities indicate the company plans to sell those assets within the year.

AFS securities indicate the company plans to hold those assets for longer than a year.

The accounting is different based on classification.

In the case of Apple. If they planned to hold WeWork debt for the short-term (for trading purposes), then the unrealized gains/losses would flow through the income statement.

So, they would need to report the losses. Reducing net income. Ouch.

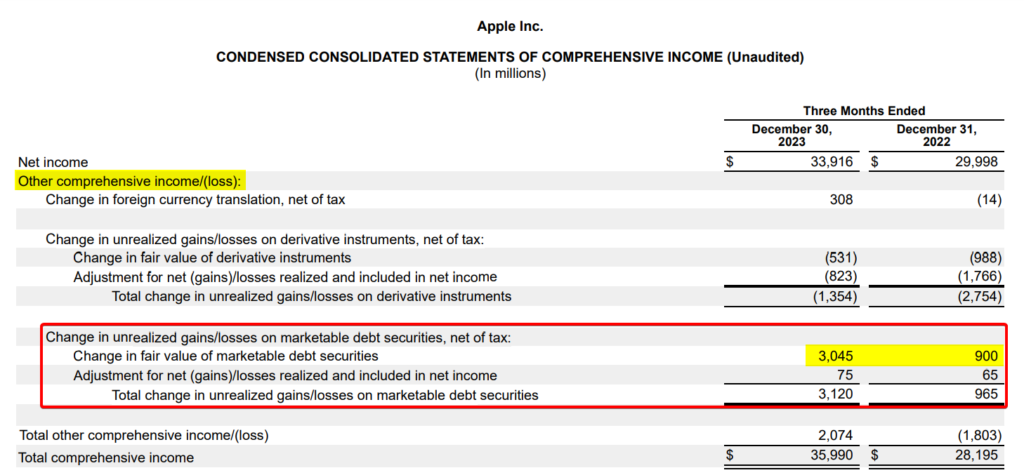

But, if Apple planned to hold the debt for the long-term (AFS), then the changes in fair value would not flow through the income statement.

Rather, they would accumulate in other comprehensive income. An equity line item.

This would balance with the changes on the assets side.

Why is this the case? Well, if firms are planning to sell assets in the near term, the unrealized gains and losses are probably more relevant than a firm that plans to hold the securities for 20 years but is seeing short-term price fluctuations.

Bottom-line? Apple would have to show losses from the WeWork investment if they were holding it as a trading security. For the short-term.