Options are not the same as shares.

Many of my students think that 1 option equals 1 share.

This is true on the surface.

A call option gives you the right to buy a share of stock at a specified price by a given date.

So, if you work for DropoutEdu and were granted 1 at-the-money option that expires in 3 months, you would have the option to exercise that option within those 3 months.

What do we mean by exercise?

You could take your 1 option and convert it into 1 share.

In doing so, you would pay the company the exercise price to get a share, which you could then sell in the market at the going price.

For instance, if the exercise price was $20 and the stock price was $25, you could buy the stock from the company at $20 and then sell it at $25, making $5.

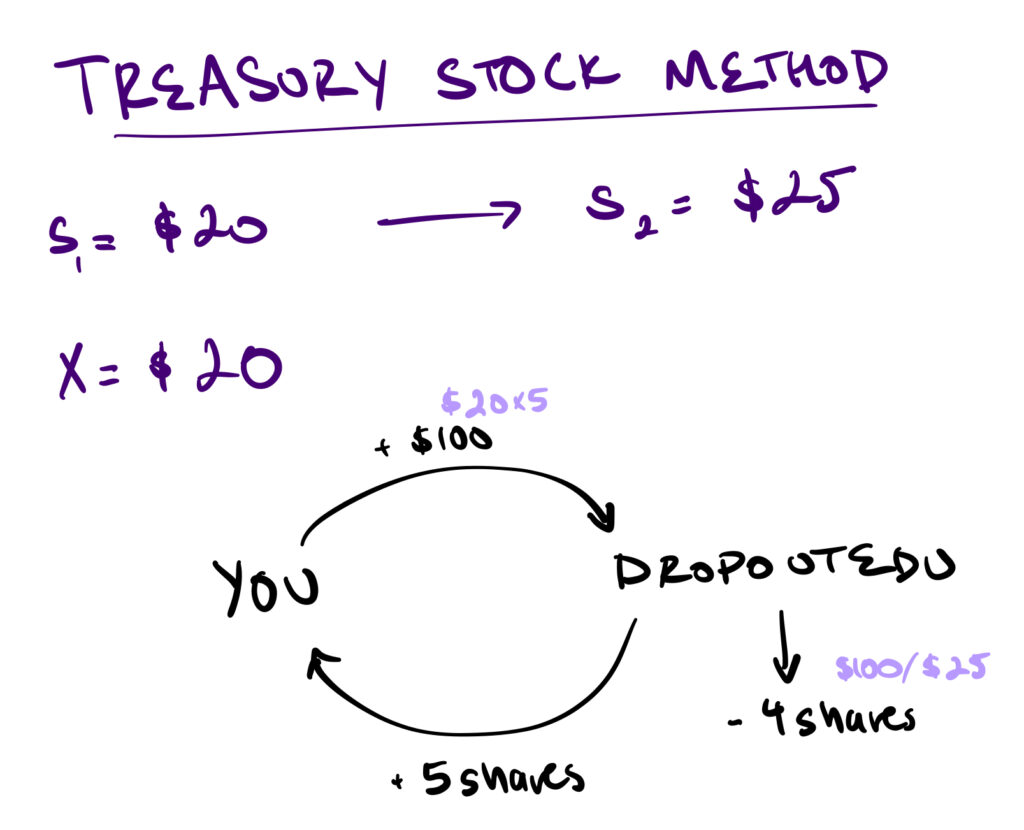

Now, say you had 5 options at the above prices.

Then, you could take those 5 options and convert it into 5 shares by purchasing $100 (5 x $20) of shares.

But, DropoutEdu in return can take that $100 in cash proceeds and use it to buy back shares of its own stock.

This counteracts the dilution that would otherwise happen from issuing options.

DropoutEdu could buy back 4 shares ($100 / $25) based on the $25 going share price.

Net, issuing 5 options only really resulted in 1 share (5 – 4) being created.

Not the 5 we initially expected.

And, this is known as the treasury stock method.

Bottom-line? Options are not the same as shares. Proceeds from exercising options can be used to retire existing shares.