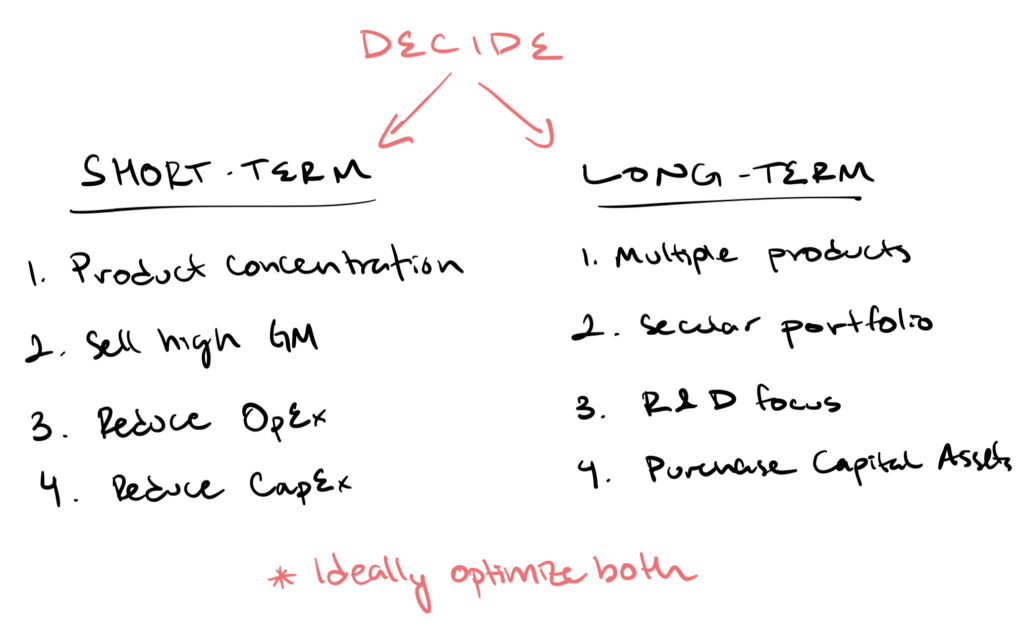

In business, there is a tradeoff between focusing on short-term and long-term financial performance.

Companies can choose to generate short-term cash flows. How so?

Sell what sticks today.

Sell high margin products.

Cut back on operating expenses.

Reduce capital expenditures.

This helps (i) expand margins and (ii) increase free cash flow generated.

But a sole focus on generating high-levels of cash flow in the near term can stifle future growth.

Innovation is the source of long-term value creation.

If a company focuses on what is working right now, it is not future proofing itself.

The moment a company stops innovating, competitors will take over. Depriving the business.

Selling products that sell today means that you are not building products for tomorrow. Your revenue is less durable.

Selling only high margin products means that you can be exposed to increased product risk.

Cutting back operating expenses can mean reduced customer service, product quality, research and development. All these reduce the quality of the goods/services and their longevity.

Reducing CapEx reduces spending in long-term projects that drive future sales. So the company will inevitably decline with time.

Focusing on the long-term means generating real enterprise value, which might come at the cost of cash flows today.

The only sustainable way to grow a business is by scaling projects that have high cash flow generation opportunities in the future that exceed the cost of capital.

The tradeoff between returns today versus in the future is hard.

Public companies must report quarterly earnings and are pressured to satisfy current investors, while setting the long-term trajectory for the broader market.

Bottom-line? Finding the right balance between near-term cash flows and long-term enterprise value creation is important. It’s why management gets paid the big bucks.