Diluted equity value. A pizza party with all your uninvited neighbors.

Dilution. It seems bad. But, what does it really mean for shareholders?

Dilution means that more people are involved, so you get less value.

Say I have a pizza party. I would want the fewest number of people showing up.

Why? Because I want the most pizza to eat.

The more people that show up, the less pizza I get.

The value gets split in more ways.

This makes each slice less valuable. This makes me not as happy.

Similarly, as a shareholder the value of the company does not change based on the number of shares outstanding.

The value of the company is determined by the fundamentals of the company. Not some arbitrary share count.

So, the more shares that get issued, the worse off I am.

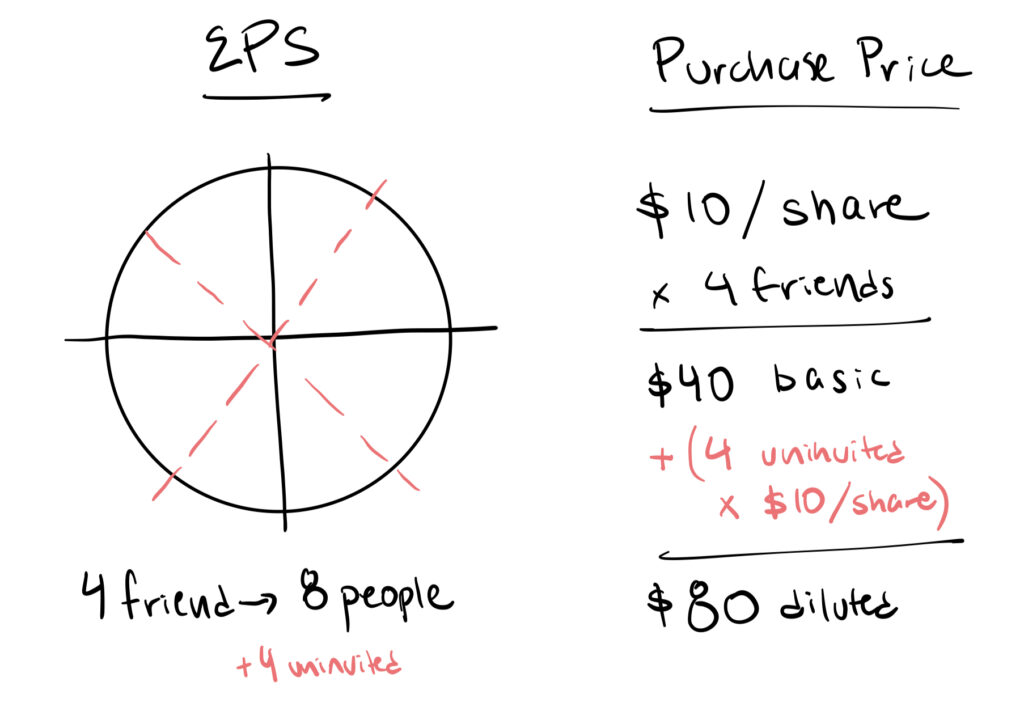

So, what does diluted share count look at?

Well, the goal of diluted shares outstanding is to value the company based on that scenario. A scenario where everyone shows up to the pizza party.

Even the uninvited neighbors show up to the pizza party. 😭

Lurking outside of the door waiting to come in.

My parents let them in.

Great. Now there is less pizza to go around. Especially now that my greedy neighbor Hugh Mungus has entered the kitchen.

This is diluted shares.

It’s the invited pizza party friends + the uninvited neighbors.

So instead of having only 10 invited friends, I have 15 people showing up (aka 5 uninvited neighbors).

So, if the value of the company is $150, it would have been worth $15 a piece. Now, with all the uninvited, it’s worth $10 a piece.

For a buyer of the company, it means that if everyone who can get equity involvement exercises their rights to it so that the buyer must purchase their shares.

For example, if I want to buy DropoutEdu, which has 100 shares and trades at a price of $10, I would pay $1,000 (100 x $10) to acquire all the outstanding shares and own the company outright.

But, if there are 10 options, I must also consider that those options can come to the party. How so?

They just exercise their rights to convert the option to a share (given it is in the money).

Now, they have entered the kitchen and get a piece of the equity.

The buyer must now acquire the additional shares from the uninvited guest turned pizza eaters.

This means that diluted equity value will be higher than the basic equity value if we had not considered the uninvited neighbors.

In the case of a buyout, we assume that all in the money options will convert creating dilution, resulting in a higher purchase price.

In the case of earnings per share, we assume that all in the money options will convert creating dilution, resulting in lower earnings per share (EPS).

Bottom-line? Dilution takes into account your uninvited neighbors.