Flexibility leads to value.

Imagine that you have an assignment due at 11:59pm.

That assignment is worth 50% of your grade.

It is currently 11:00pm and you haven’t started.

You are panicking.

Say I am the professor of that class.

How much would you pay me to give you the option to submit the homework 1 day late?

Well, you would pay as much as it is worth on your grade. And, the effects of that grade on your career prospects.

Since the assignment is what will get you an A or fail the class, the option to delay the deadline is very valuable.

So, you would probably pay a lot.

You win. The professor wins.

Both parties are happy.

The same goes with companies.

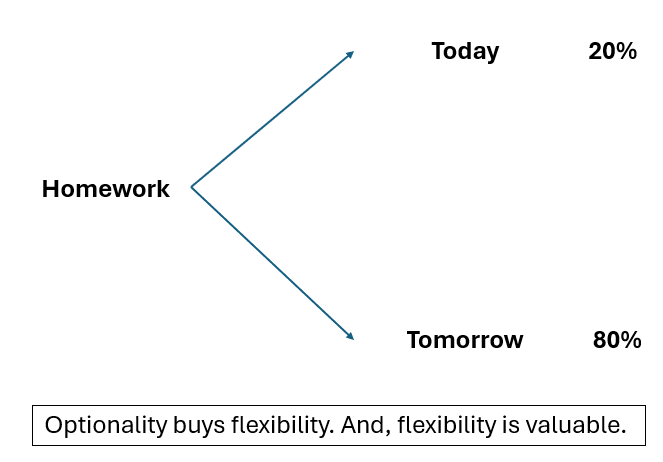

If they have the option to delay an investment to a later date it is valuable.

Why not just invest today?

Investing is not so simple. There can be information asymmetry.

As management, we may not have clarity on whether the project we invest in will payoff as expected.

The uncertainty makes flexibility valuable.

You did not know if you could complete your homework in time. But, you were willing to pay for the flexibility to delay your deadline.

This is the same flexibility that companies would buy.

This is known as having the option to exercise the investment at a future date.

This option has value – conveniently termed option value.

Bottom-line? Flexibility to make decisions at a later date is valuable. We would pay a premium for it.