Would you ever lend me money for free? And charge no interest. Probably not.

Well, maybe, if you are my friend. But, it’s unlikely that you would lend money for nothing in return.

Why? Well there is risk that stems from the uncertainty on whether you will get your money back.

For that risk, you ask me to compensate you. And, if I want your money, I must agree to your terms, or try negotiating.

The same goes for any company looking to raise debt.

But then, why are there zero-coupon bonds in the first place?

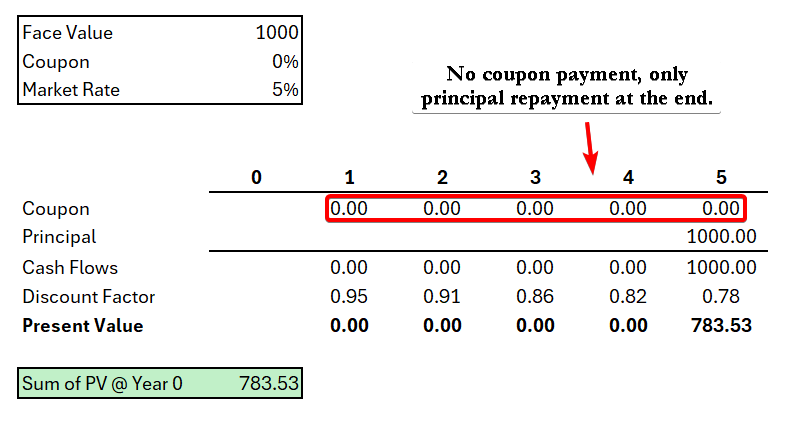

Coupon, referring to the interest payment that is made on the bond over the life of the bond.

Wouldn’t you want some form of compensation for the risk you take on? So, then, who are the buyers of these bonds?

Well, no one based on the way I described them.

The only way investors will purchase zero coupon bonds is for less than their face value.

You still demand compensation for the risk you take on. That risk does not just magically disappear.

So, you give me less today, and demand that I repay more to you at the time the bond matures.

How do investors determine how much to issue you. Well, that all depends on how risky you think I am.

If you think I am junky and cannot pay you back, then you will demand 10% returns and discount the $1,000 I asked for by 10% over 5 years.

If you think I am responsible civilian, then you will demand 1% returns and discount the $1,000 I asked for by 1% over 5 years.

Hopefully, it’s the latter.

Which company wants to spend more money to borrow cash? None.

Bottom-line? A zero-coupon bond is not really zero interest. Your interest and principal is all paid out at the end.