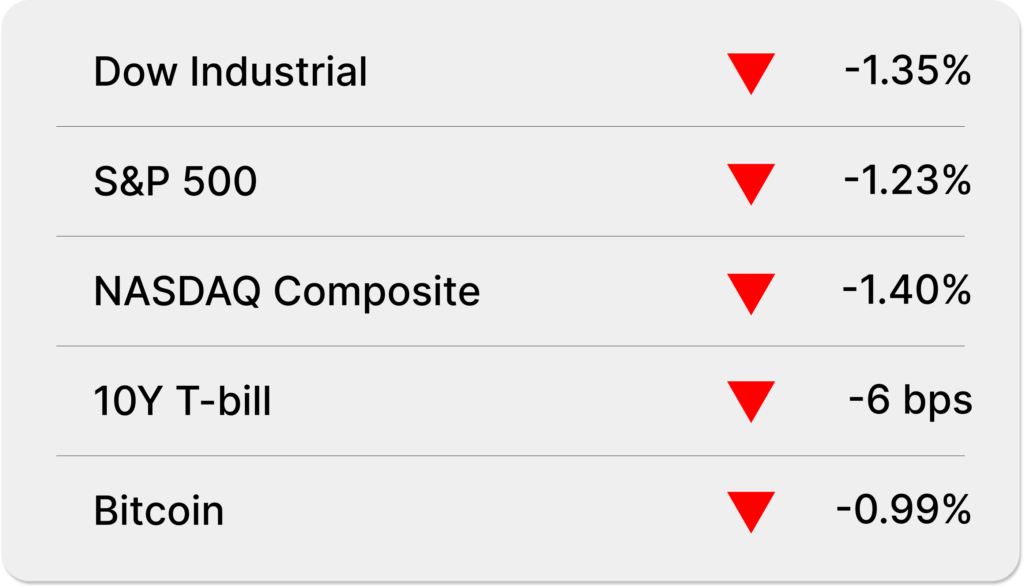

Markets

Key Events

U.S. equities finished down Thursday.

👉 Initial jobless claims at 221K – above consensus of 213K.

Feds are looking for inflation to come down and employment to fall to cut rates by year end.

Watching for nonfarm payrolls, released tomorrow.

👉 Ford to delay production of its electric SUV and pickup.

3-row SUV pushed back from 2025 to 2027.

T3 pickup pushed back from 2025 to 2026.

Why? Customer adoption of EV was slower than initially expected, plus EV infrastructure is not cheap. Overall delay and cut back of $12bn of EV related spend.

Still the 2nd largest EV producer by number behind Tesla and committed to that.

👉 Google reportedly speaking with its advisors, Morgan Stanley, in considering a $35B offer for HubSpot.

HubSpot is a leading provider of inbound marketing, sales, and customer relationship management (CRM) software.

Google had $110.9 billion in cash on the balance sheet at the end of the calendar year. This acquisition would be an attempt to better invest cash on hand to generate returns if not directly returned to investors in the form of share buybacks or dividends.

Though the Company still reports a net loss, HubSpot shares popped 11% and closed up ~5%.

Mergers and Acquisitions

Paramount is in exclusive merger talks with Skydance Media, entertainment company run by by David Ellison (Oracle founder’s son).

Private Equity

TPG to buy Classic Collision, an auto body repair shop in Atlanta, from New Mountain Capital. Details not disclosed.

Private Equity

Aerospike, a NoSQL database, raised $100m in Series E funding, capitalizing on the AI boom.